Level Up Your Business Today

Join the thousands of people like you already growing their businesses and knowledge with our team of experts. We deliver timely updates, interesting insights, and exclusive promos to your inbox.

Join For Free💳 Save money on credit card processing with one of our top 5 picks for 2025

Both Square and Gusto offer affordable and easy to use payroll software for small businesses. Which one is the best fit for your needs?

When comparing the best payroll software for small businesses, the battle between Square Payroll vs. Gusto is a close one. The good news is that you can’t really go wrong, as both companies offer user-friendly software, solid feature sets, and affordable pricing. But one option might be significantly better for your specific needs, and that’s where we’re here to help.

We’ll dive into each software’s features, pricing, integrations, and more to find out which software is the best option for your business.

| Square | Gusto | |

|---|---|---|

| Ideal For | Independent contractors and businesses with simple accounting needs | Small to mid-sized businesses needing complete payroll software |

| Pricing | $6/contractor to $35/month + $6/employee + add-ons | $49/month + $6/person – $180/month + $22/month per person |

| Standout Features |

|

|

| What’s Missing |

|

|

Table of Contents

Both Square Payroll and Gusto have affordable pricing, strong customer support, intuitive interfaces, unlimited payroll runs, and a slew of similar features, putting each of them on our list of the best small business payroll software.

The main differences between these payroll options are that Square payroll has a mobile app and integrates with a suite of other Square products, which Gusto offers better benefits and HR features (though some benefit administration options aren’t available in every state).

There are several other more nuanced differences between Square Payroll and Gusto, so let’s dive into the full comparison.

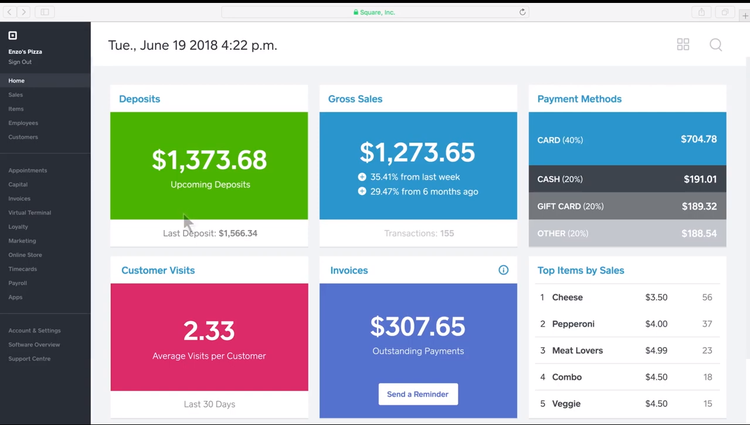

Square is well-known in the small business community for its multitude of products and services, such as point of sale (POS) and payment processing. Square Payroll checks the boxes for easy use and compliance. With any subscription, Square’s features cover all essential payroll functions like direct deposit and tax filing.

For small businesses already using other Square products, tacking on Square Payroll is a logical choice to further integrated operations. For instance, businesses with Square POS can carry over its time-tracking functions at the register for employees to clock in or out of their shifts. It’s as easy as setting up each employee with their own unique code in the system.

The other areas where Square Payroll wins include:

Customers who need greater customization in their payroll scheduling and deductions have taken issue with Square’s inability to accommodate their unique needs.

Other drawbacks of Square Payroll include:

Outside its own applications, Square Payroll has 20+ other possible integrations, most notably QuickBooks, TSheets, and ZipRecruiter. This number is quite small compared to Gusto’s integrations suit.

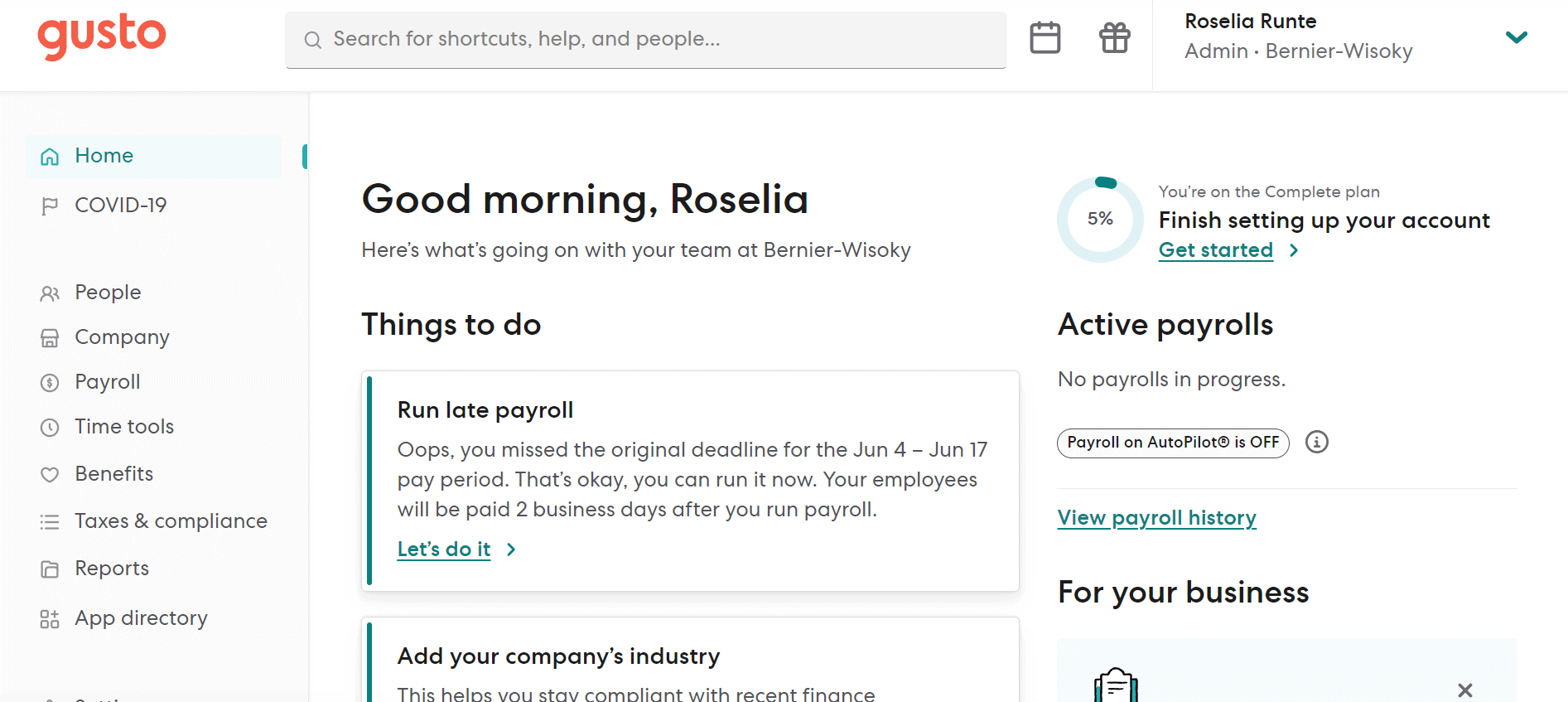

Gusto is a cloud-based payroll platform with a reputation for its straightforward interface and the ease at which it can automatically calculate payroll and tax filings. Gusto supports flexible payment schedules too, which comes in handy whether following a standard bi-weekly plan or periodically doling out bonuses and commissions.

Gusto is effective at integrating other aspects of business, such as HR, employee onboarding, and benefits administration, plus the company offers many more software integrations than Square Payroll.

Other perks of Gusto include:

The biggest issue with Gusto is that health insurance is not available in Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North and South Dakota, Rhode Island, or West Virginia. Additionally, if you use multiple Square products already, Gusto won’t have the direct integration capabilities you would find by using Square Payroll.

Other limitations of Gusto include:

| Square Payroll | Gusto | |

|---|---|---|

| Price | $6/contractor to $35/month + $6/employee + add-ons | $49/month + $6/person to $180/month + $22/month per person |

| Number of users | Unlimited | Unlimited |

| Discounts available | No | No |

Square Payroll and Gusto have similar pricing plans in that they both have low-cost entry points for small to mid-sized businesses, but a few key differences might help sway you one way or the other.

Square’s Payroll pricing is ideal for very small businesses that only have a handful of independent contractors and costs $6/contractor paid. This also comes with access to various add-ons like health and retirement benefits. For more features, you can subscribe to the Pay Employees & Contractors plan for $35/month + $6/employee, which comes with features like timecards and an employee app plus tax support.

Gusto’s payroll pricing has a few more options and is slightly more expensive, but also has additional features. Like Square Payroll, Gusto has a contractor-only plan that’s $35/month + $6/person per month. Plans to pay employees and contractors start at $49/month + $6/person.

As you would probably expect from the pricing differences, Gusto does come with additional features that Square’s base package does not, so, depending on what you might need to add on with Square Payroll, the overall costs could end up being similar. Gusto’s Plus package comes with additional reports and employee tracking, and it also offers far more benefit options than Square Payroll.

The Bottom Line On Gusto VS Square Payroll Pricing: If you’re looking for a complete payroll software system with everything included, Gusto is probably the simplest choice. If you won’t need to tack on multiple features a la carte from Square’s basic services, Square Payroll will likely be more affordable.

| Feature | Square Payroll | Gusto |

|---|---|---|

| Payroll processing | ||

| Tax Filing | ||

| Direct Deposit | ||

| Unlimited Pay Runs | ||

| Time Tracking | ||

| Benefits Administration | Costs extra | |

| New Hire Reporting | ||

| Mobile App | ||

| Reporting | ||

| Employee Management |

On the surface, Square and Gusto have many of the same payroll features. However, the functionality and cost of certain features are quite different in practice.

Let’s take a closer look at Gusto vs Square payroll to see how they stack up on some key features.

Read our Gusto review and Square Payroll review for a more detailed breakdown of each company’s features and capabilities.

There’s no one-size-fits-all approach to running a small business, and the same goes for processing payroll. For the most part, small business customers are satisfied with Gusto and Square Payroll. That being said, there are some situations when one option outweighs the other.

With detailed HR and benefits administration, more advanced payroll features, and more software integration options, Gusto is the overall best fit for small businesses.

However, certain small businesses might prefer Square Payroll. If you don’t need the advanced features of Gusto, Square Payroll is more affordable. And if you do need direct Square integrations, Square Payroll can be a great asset for businesses already using the Square suite. The other biggest use case for Square Payroll is if you need a mobile app option since Gusto surprisingly doesn’t offer a mobile app at all.

Still undecided? Here are some points to consider.

Once you’ve made a decision, check out our content on how to run Square Payroll or how to run Gusto. Or, if you want to explore other options, check out the cheapest payroll software for businesses or compare Gusto and Square to other products:

Free Trial: Try A Top Pick For Payroll

Gusto  |

|---|

Gusto is an all-in-one people platform that simplifies payroll many human resources tasks. Get Started.

Free Trial: Try A Top Pick For Payroll

Gusto  |

|---|

Gusto is an all-in-one people platform that simplifies payroll many human resources tasks. Get Started.

Let us know how well the content on this page solved your problem today. All feedback, positive or negative, helps us to improve the way we help small businesses.

Give Feedback

Want to help shape the future of the Merchant Maverick website? Join our testing and survey community!

By providing feedback on how we can improve, you can earn gift cards and get early access to new features.

Our reviewers like ADP Payroll for its advanced employee management, strong payroll features, and great customer support. For a limited time, get three months free.

View Offer

Our reviewers like ADP Payroll for its advanced employee management, strong payroll features, and great customer support. For a limited time, get three months free.

View Offer

Help us to improve by providing some feedback on your experience today.

The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation.

Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication. Merchant Maverick’s ratings are not influenced by affiliate partnerships.

Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are author’s alone.

Our reviewers like ADP Payroll for its advanced employee management, strong payroll features, and great customer support. For a limited time, get three months free.

View Offer

Our reviewers like ADP Payroll for its advanced employee management, strong payroll features, and great customer support. For a limited time, get three months free.

View Offer