Get Matched With POS Software

Take our short quiz to get matched with the best point-of-sale software for your unique business needs. Instant results, no phone number or email required.

Start QuizThis payment service provider gives Square and PayPal a run for their money with its many processing features and services.

| Total Rating | 4.5 |

|---|---|

| Fees & Rates4.8 | |

| Products & Services4.2 | |

| Contract4.4 | |

| Sales & Advertising Transparency5.0 | |

| Customer Service4.2 | |

| User Reviews4.0 | |

Table of Contents

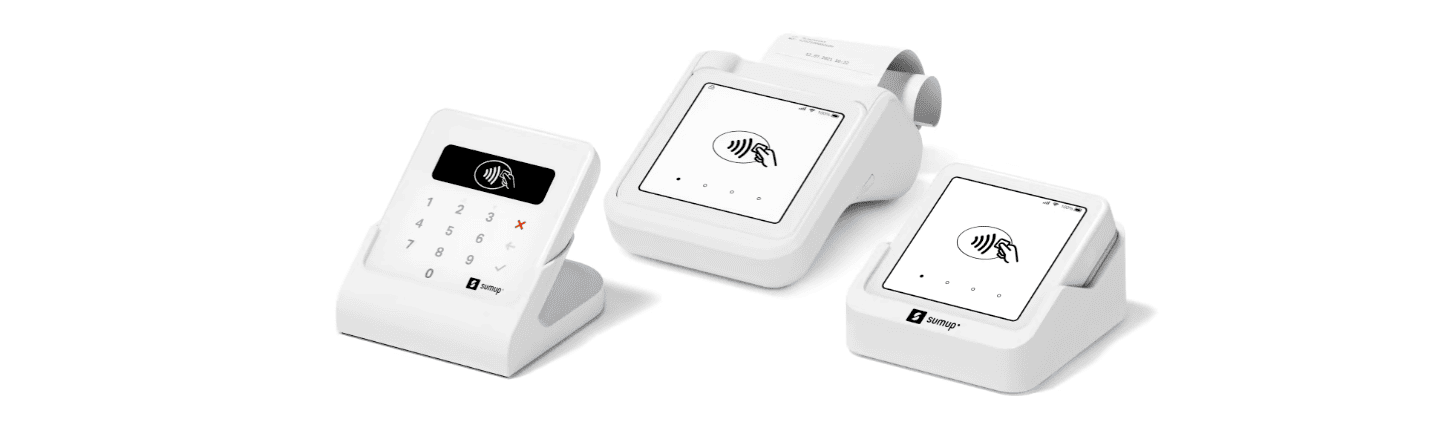

SumUp is a payment service provider that offers in-person payment processing through its SumUp app, mobile SumUp card readers, and POS systems. The SumUp app is similar to its closest competitors, Square and PayPal Zettle, making SumUp a good option for low-volume and mobile sales.

Besides SumUp’s fees being lower than Square’s for small tickets, SumUp’s pocket-sized credit card reader has some features the Square mobile reader doesn’t have, giving SumUp a slight leg up on its competition (though SumUp’s software features are slightly more basic). SumUp’s quality as a mobile processing solution is reflected in the many positive SumUp reviews, at least from its many international users.

SumUp offers more payment processing features and merchant services in the UK and Europe than it does in the United States. Nonetheless, it’s a viable alternative to Square for mobile and brick-and-mortar merchants due to its affordable processing equipment and competitive processing rates.

| Products & Services4.2 |

|---|

| Software & Services 4.3 |

| Hardware & Equipment 4.0 |

Mobile credit card processing is SumUp’s core feature, but the app also has many free POS features, as well as advanced POS features that require a paid plan and countertop processing hardware.

The SumUp app features all of the standard mobile POS features, including:

The remote payment features, even if basic, are nice to have. SumUp lets you send customers a payment link, allowing them to pay you on their phone or computer. You can also share a digital gift card link on your social media, website, or directly with customers. Just keep in mind that you’ll pay the higher card-not-present fee for those types of transactions.

As you can see below, SumUp offers nearly all core/basic POS features that small businesses need, though some features require a POS subscription rather than the free mobile plan. Overall, the feature set is somewhat more basic than Square’s but should still be sufficient for most small, mobile businesses.

| SumUp Features | Availability |

|---|---|

| Multi-Store Support | |

| Contactless Payments | |

| Multi-Channel Selling | |

| Gift Cards | |

| Customer Loyalty | |

| Marketing Tools | |

| Online Ordering | |

| Inventory Management | |

| Reporting | |

| Menu Management | |

| Delivery Management | via paid Deliverect integration |

| EBT Acceptance | |

| Employee Management | |

| Text Messaging |

Here are some further details about SumUp’s best software features and hardware.

| Fees & Rates4.8 |

|---|

| Pricing 4.6 |

| Affordability 5.0 |

Like most payment service providers (PSPs), SumUp uses a simple, flat-rate pricing plan that makes it easy to anticipate what your overall processing costs will be in advance. SumUp’s rates compare favorably with its main competitors, PayPal and Square.

SumUp will deliver your funds (minus its fees) to your bank in one to two business days (two to three business days in the UK). There’s no instant deposit option, but this timeframe is standard for card processing.

| Item | Value |

|---|---|

| Pricing Range | $0-$289/month |

| Account Setup Fee | $0 |

| Contract Length | Month-to-month with mobile card reader only; POS plans require a 12-month subscription |

| Processing Model | Flat-rate |

| Card-present Transaction Fee | 2.6% + $0.10 |

| eCommerce Transaction Fee | 3.5% + $0.15 |

| Keyed-in Transaction Fee | 3.5% + $0.15 |

| Equipment Cost | $54-$799+ |

Note that customized processing fees are available to US merchants processing over $10,000/month.

| SumUp Plans | Price | When To Use |

|---|---|---|

| Free plan | $0/month (plus one-time purchase of $54 SumUp Plus or $99 SumUp Solo) | If you want free mobile credit card processing with a SumUp card reader. |

| POS Lite | $0/month (plus one-time $499 hardware purchase) | If you want a free countertop POS and do not need advanced back-office features. |

| SumUp POS | $99-$289/month (plus one-time $799 hardware purchase) | If you want a countertop POS with advanced back-office features and customer loyalty. Includes Connect Lite, Connect Plus, and Connect Pro tier options. |

As you can see, the POS plans do charge a monthly fee; they also require a 1-year commitment.

| SumUp Extra Costs | Price |

|---|---|

| Invoice transactions | 2.9% + $0.15 |

| Online ordering | $19/month |

| Chargeback fee | $10/incident |

Like Square, SumUp has no account setup fee, no hidden monthly fees, no PCI compliance fees, no monthly minimums, and no early termination fees if you close your account early.

| Sales & Advertising Transparency5.0 |

|---|

| Sales Practices 5.0 |

| Web Presence 4.9 |

Overall, SumUp is straightforward and transparent in its operations. The pricing is clearly laid out, and the contract terms are fair. There are no gimmicky offers on the site and no undeliverable promises. The complaints against SumUp are the standard fare. They’re not unique or even uncommon, which are the sort of problems typically indicative of more significant issues.

Like most other mPOS providers, SumUp relies on word of mouth and online advertising. You will not encounter a sales team in the field offering demos. We like this approach because independent resellers and sales reps tend to promise the world to merchants — but they rarely deliver.

One word of caution: If you are a high-risk merchant, SumUp will not do business with you. (Examples of businesses considered “high risk” by payment processors include pawn shops, adult entertainment, and debt service businesses.) Instead, you’ll need to find a reputable high-risk merchant account.

While this is true with other payment service providers as well, it has generated a lot of unfounded complaints from merchants who signed up and then had their accounts terminated once they started processing — and after they’d already purchased a SumUp card reader. We feel the company could do a much better job at clarifying this restriction before merchants sign up.

| Contract4.4 |

|---|

| Commitment 4.7 |

| ETF & Other Fees 4.0 |

SumUp uses a pay-as-you-go model, and the basic mobile plan has no long-term contract or early termination penalty for canceling your account at any time. However, SumUp POS plans require a 12-month commitment. This isn’t ideal, and the plan also requires a hardware bundle purchase, which is a commitment in and of itself— if you purchase all this POS equipment you can’t use with another provider, you probably aren’t going to give up and switch to another POS within a year (unless the service is really, really bad).

There is no commitment or monthly minimum required for the free mobile processing plan; however, if your account is inactive for two years, SumUp will terminate it and follow the standard procedure in your state for the disposal of any funds in the account, if there are any (there probably won’t be).

The terms of use are pretty standard for a mobile processor. Like Square and PayPal, SumUp’s Terms of Use include the right to implement a rolling reserve fund on your account and to hold funds if it notices something suspicious. Although SumUp’s terms are very loose and don’t contain any truly unpleasant surprises, we strongly encourage you to read the Terms & Conditions section very closely before you sign up for an account. There are a lot of provisions that you’ll want to be familiar with before you start taking credit card payments.

| Customer Service4.2 |

|---|

| Personal Support 3.8 |

| Self-Service 4.6 |

SumUp offers email/ticket-based support. You can access it through the SumUp app and the website. SumUp’s US-based Support Center site has answers to lots of commonly asked questions and extensive documentation for the SumUp app and its card readers. You’ll also find SumUp’s exhaustive list of restricted businesses, although it’s very unlikely that you’ll stumble across it before signing up for an account.

You can also reach SumUp via telephone on weekdays from 9 AM-7 PM EST. SumUp reviews concerning the quality of phone support are not 100% glowing but are largely positive. True 24/7 phone support is also now available to customers who subscribe to one of SumUp’s Point-of-Sale plans.

| SumUp Customer Service | Availability |

|---|---|

| Phone Support | |

| Email Support | |

| Support Tickets | |

| Live Chat | |

| Dedicated Support Representative | |

| Knowledge Base or Help Center | |

| Videos & Tutorials | |

| Company Blog | |

| Social Media |

| User Reviews4.0 |

|---|

| Customer Feedback 4.0 |

| Review Site Aggregate 4.0 |

SumUp app reviews are mostly positive, though there are more international reviews than US reviews (and more Android than Apple users, it would seem).

SumUp has an entry on the BBB website with a D- rating, though it isn’t accredited. The company has received 22 BBB complaints over the past three years, with 8 of them coming in within the last twelve months. This isn’t a high complaint volume considering the company’s size, though the D- rating is due to the fact that the company hasn’t responded to its BBB complaints.

On the Google Play store, SumUp has an average rating of 3.9 out of 5 stars, based on 119K reviews. On the Apple App Store, SumUp has an average rating of 4.7 out of 5 stars based on 12,825 reviews. It’s clear the app is more popular among Android users.

| SumUp Review Summary | |

|---|---|

| Pricing Range | $0-$289/month |

| Choose If You Need |

|

Despite a few minor shortcomings, SumUp is a good choice for many small businesses. The card readers are robust enough for just about any type of mobile sales, and the optional POS plans make SumUp well suited to a broader variety of businesses. It’s easy to sign up for an account online, and setting up your hardware is also very straightforward.

Like any other payment service provider (or third-party payment processor), SumUp’s aggregated accounts run a higher risk of holds, freezes, or terminations. However, this risk is still very low for a low-risk business that only takes card-present transactions. As your business grows, transitioning to a traditional merchant account will minimize this risk and cost less overall.

SumUp may be an imperfect solution, but it scores well overall and can meet the needs of most small, retail-only US businesses. For more on how SumUp stacks up against Square, read our SumUp VS Square comparison to see more details on these two providers.

If you’d like to see even more payment processing choices for your business that include not just mobile processors but also true merchant account providers, check out the best credit card processors for small businesses.

We evaluate and test each payment processor that we review at Merchant Maverick, placing special emphasis on certain key characteristics in order to generate our granular ratings for merchant accounts and credit card processors.

For payment processing reviews, we use a 24-point rubric to evaluate the provider. First, we look at pricing structure – interchange plus, subscription-based, tiered, or hybrid – giving the most points to providers that provide fair, transparent pricing and docking those that rely on tiered models. Then we examine rates, the presence and transparency of early termination fees, and any additional fees.

We also look at contract length and fairness and test out sales staff and customer service channels ourselves to ensure that the company uses reputable, above-the-board sales techniques. Finally, we take the company’s online reputation into account, reading customer reviews and comments.

Read more about how we rate payment processors.

The Merchant Maverick Seal of Approval 🏆

|

SumUp

|

|---|

After hours of in-depth research and evaluation, we can confidently recommend this brand to our readers. Get started today and see SumUp for yourself.

The Merchant Maverick Seal of Approval 🏆

|

SumUp

|

|---|

After hours of in-depth research and evaluation, we can confidently recommend this brand to our readers. Get started today and see SumUp for yourself.

Let us know how well the content on this page solved your problem today. All feedback, positive or negative, helps us to improve the way we help small businesses.

Give Feedback

Want to help shape the future of the Merchant Maverick website? Join our testing and survey community!

By providing feedback on how we can improve, you can earn gift cards and get early access to new features.

Our team of experts spends hours on every review so that we can find the best companies to recommend to our readers. SumUp made the cut.

Learn More

Our team of experts spends hours on every review so that we can find the best companies to recommend to our readers. SumUp made the cut.

Learn More

Help us to improve by providing some feedback on your experience today.

The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation.

Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication. Merchant Maverick’s ratings are not influenced by affiliate partnerships.

Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are author’s alone.

Our team of experts spends hours on every review so that we can find the best companies to recommend to our readers. SumUp made the cut.

Learn More

Our team of experts spends hours on every review so that we can find the best companies to recommend to our readers. SumUp made the cut.

Learn More