Pros

- No application or account setup fees

- Reasonable rates and fees

- Free credit card terminal available

- Few public complaints

Cons

- No publicly disclosed pricing

- No offshore accounts

What Is PaymentCloud?

PaymentCloud Inc. is a Los Angeles, CA-based merchant services provider that serves high-risk businesses. PaymentCloud was acquired by Electronic Merchant Services (EMS) in January 2024 but has continued to maintain its high quality of service since the acquisition.

PaymentCloud specializes in providing merchant accounts to mid and high-risk businesses. PaymentCloud will accept businesses from virtually any industry, as well as merchants with bad credit.

PaymentCloud’s merchants are mostly based in the US, but merchants located elsewhere in North America and in the EU can also use PaymentCloud. PaymentCloud does not offer offshore accounts (a type of high-risk merchant account that lets merchants accept payments using a bank outside of their home country).

Overall, PaymentCloud rates as one of the best high-risk merchant account providers, and it’s also among the best credit card processors for small businesses that we’ve reviewed.

Products & Services

Like most high-risk merchant account providers, PaymentCloud is not a direct processor. Instead, PaymentCloud partners with numerous banks and processors to maximize your odds for initial approval and ongoing account stability.

PaymentCloud is a registered ISO/MSP of BMO Harris Bank, Chesapeake Bank, Esquire Bank, Merrick Bank, and several others. Partnered processors include EMS (Electronic Merchant Services), Elavon, EVO Payments, Global Payments, PaySafe, and more.

Determining the best combination of bank and processor for your specific industry and business situation is one of the primary services PaymentCloud provides. Let’s take a closer look at more of the products and services PaymentCloud offers.

Features Overview

| PaymentCloud Features |

Availability |

| Dedicated Merchant Account |

|

| PCI Compliance |

|

| High-Risk Accounts |

|

| International Accounts |

|

| Contactless Payments |

|

| ACH Processing |

|

| Digital Wallet Acceptance |

|

| EBT Acceptance |

|

| Virtual Terminal |

|

| Mobile POS Reader & App |

|

| Hosted Online Store |

|

| Payment Links |

|

| Payment Gateway Integrations |

|

| Shopping Cart Integrations |

|

| POS Integrations |

|

| BNPL Integrations |

|

| API Documentation |

|

| Currency Conversion |

|

| Recurring Billing |

|

| Invoicing |

|

| Cash Discount Program |

|

| Cryptocurrency Processing |

|

Card-Present Features

- Credit Card Terminals: PaymentCloud offers the option of a “free” terminal with the opening of a new merchant account. While the terminal isn’t really free, you won’t be directly charged for using it. Provided equipment is essential loaned to you for only as long as you maintain your account. If you close your account, you must ship the terminal back to PaymentCloud immediately to avoid being charged the full cost of the machine. Fortunately, you also have the option to purchase a terminal. PaymentCloud offers a host of terminals from major manufacturers, including Verifone, Ingenico, Dejavoo, Poynt, PAX, Clover, and others. These machines are all EMV-compliant, and most also support NFC-based payment methods, such as Apple Pay and Google Pay. Wireless models are available as well.

- Point Of Sale (POS) Systems: These systems are provided through PaymentCloud’s back-end processors and include Clover devices such as the Clover Station Duo. Many other options are also available; you can usually choose between tablet-based systems and dedicated registers.

- Mobile Payments: You’ll have several options for mobile hardware. These include Bluetooth and audio-jack card readers compatible with iOS and Android that incorporate EMV and contactless payments. This equipment and any associated payment app will depend on your back-end processor. The website has little specific information on this topic, so consult a sales representative for more details.

Card-Not-Present Features

- Payment Gateway: For online processing, PaymentCloud prefers the popular Authorize.Net payment gateway. USAePay is typically PaymentCloud’s second-in-line option, but you can also use most other well-known providers or your current gateway. The Authorize.Net gateway includes a developer toolbox with open API if you need to customize your site’s integration. While gateway setup is free with PaymentCloud, look for a monthly subscription fee that the gateway provider itself charges.

- Virtual Terminal: This feature is useful for mail-order and telephone-order (MOTO) merchants. You can manually enter transactions or even email invoices to clients through this system. Virtual terminals can also process card-present transactions with the addition of an optional card reader. A virtual terminal feature is included with each of the gateways PaymentCloud offers.

- Shopping Cart Integration: For eCommerce merchants, PaymentCloud integrates with a wide variety of online shopping carts. Popular carts that PaymentCloud supports include Shopify, BigCommerce, and Shift4Shop.

- ACH & eCheck Processing: ACH processing allows you to process direct debit payment methods from your website. PaymentCloud sets up processing for ACH and echeck much less frequently than for cards, but it’s worth noting that extremely high-risk merchants may start with an ACH-only account if credit card processing is not possible.

Additional Services

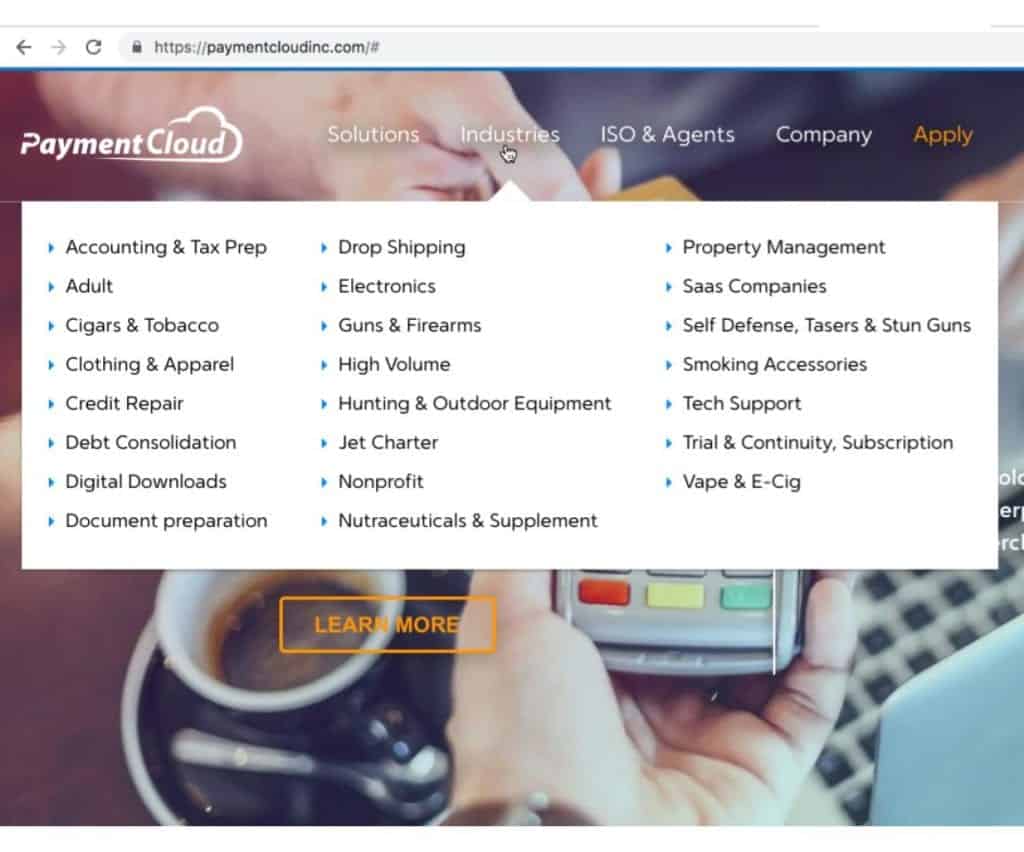

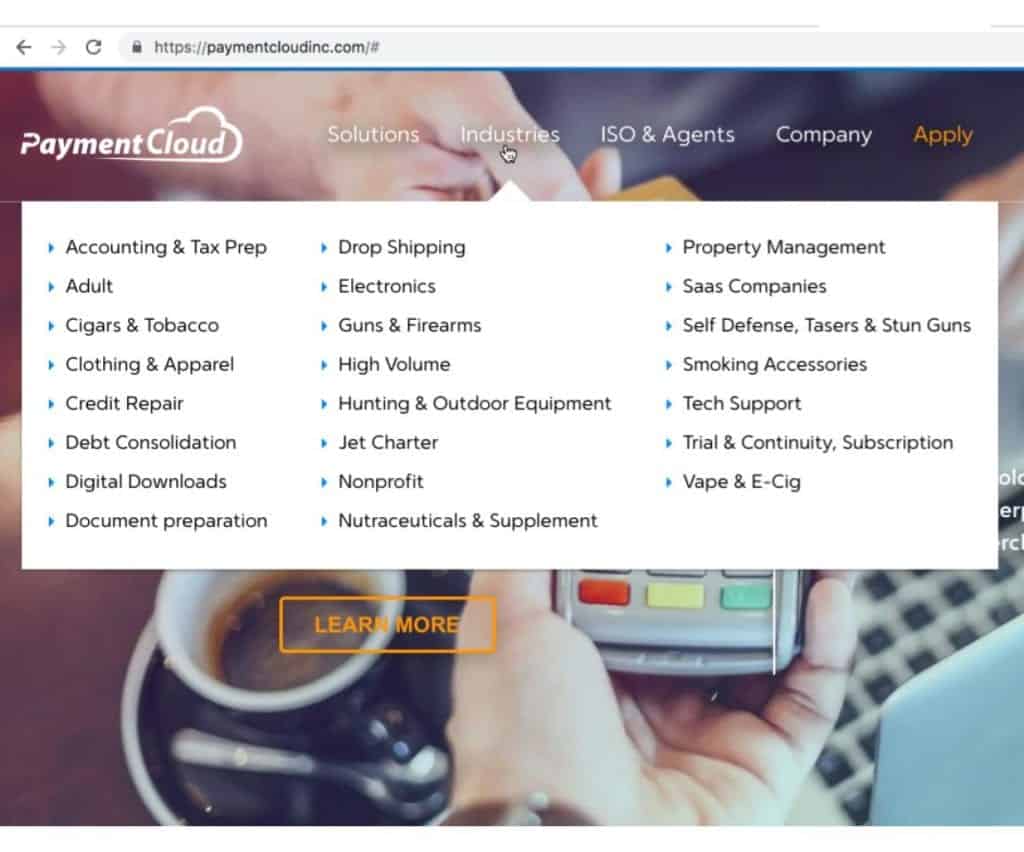

- High-Risk Industries: PaymentCloud serves a large number of high-risk industries, including adult websites, nutraceuticals and supplements, electronic cigarette vendors, debt consolidators, CBD vendors, and many others. While the company doesn’t post a list of prohibited activities, it’s important to note that the processing landscape for high-risk industries is constantly shifting. Your best bet is to ask PaymentCloud about the current prospects for your industry.

- Customized Application Guidance: PaymentCloud calls this process “scrubbing.” To maximize your chances for account approval and to secure the best deal possible, PaymentCloud will scrub your supporting documents, your website and social media presence, and all other components of your application, looking for any red flags that could hinder your prospects. The team will then guide you toward specific changes you can make and additional or alternative supporting documents you can supply to improve your situation in the eyes of your underwriters.

- Cryptocurrency Processing: PaymentCloud offers cryptocurrency processing for businesses that want to use it. While this is becoming an increasingly popular way to avoid the expensive interchange fees associated with credit card payments, note that there is still a transaction processing fee that applies when accepting Bitcoin or any other form of cryptocurrency.

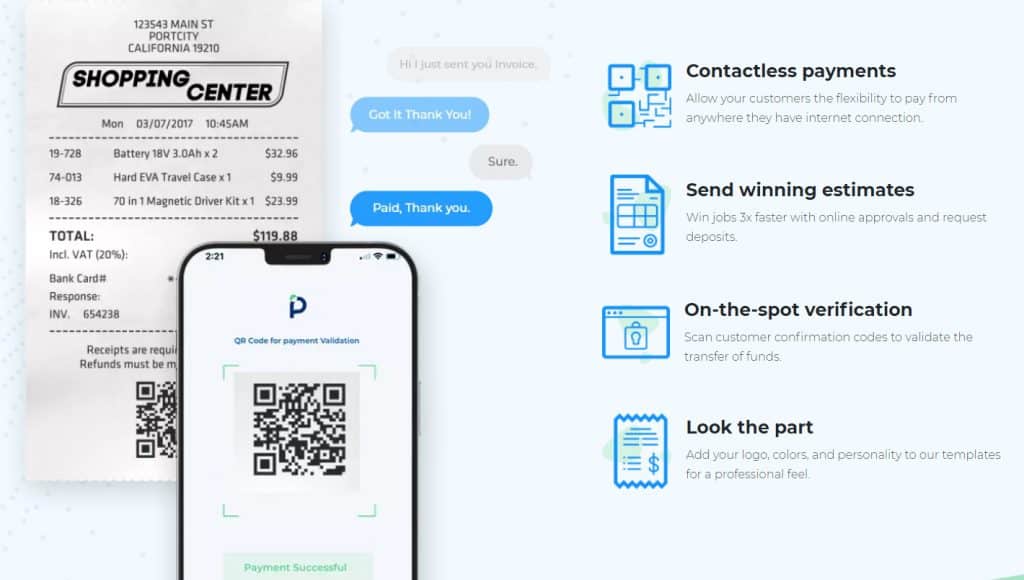

- Contactless Payment Requests: Advertised under the unintentionally funny tagline “Where every customer’s phone is a POS,” PaymentCloud offers the Paysley contactless payment service, which allows you to send customers a QR code for secure payments. Customers can pay online by inputting their card information or by using their Apple Pay or Samsung Pay accounts without having to download an app or register with the service.

- PCI Compliance: Once you’ve set up your account, you have 90 days to become PCI compliant, and PaymentCloud will guide you in the necessary steps — all without charging a PCI compliance fee.

- Data Migration: This is often a huge headache and usually requires developer assistance. PaymentCloud specializes in data migration for your recurring billing customers over to Authorize.Net from platforms such as Stripe. Generally speaking, PaymentCloud excels in the recurring billing space and not just for high-risk clients.

- Personalized Deployment: PaymentCloud ensures your system is working correctly by setting up test transactions and providing detailed guidance in operating your payment gateway. The same goes for setting up processing hardware.

- Chargeback & Fraud Prevention: Chargebacks are a major concern in high-risk industries, and PaymentCloud will help you protect yourself as much as possible. Along with giving advice on choosing a chargeback management service and setting up fraud mitigation services (such as 3D Secure), PaymentCloud takes you step-by-step through customer support techniques and systems that will help keep your customers satisfied. Happy customers are less likely to initiate chargebacks in the first place!

- QuickBooks Integration: PaymentCloud integrates with QuickBooks Online, allowing merchants to automatically sync their sales data for cash, credit card, and ACH transactions. In addition, PaymentCloud allows next-day deposits of funds with QuickBooks.

- Ongoing Negotiation & Advocacy: Your dedicated account manager acts as your advocate in dealing with your bank and processor for the lifetime of your account. Perhaps your funds have been held, or your account is under threat of closure. Or things are looking up, and you’re ready for a lower reserve or higher processing limits. Either way, PaymentCloud works on your behalf to negotiate what you need.

- Merchant Cash Advances: PaymentCloud offers merchant cash advances (MCAs) to qualified businesses through a partnership with Wisco Capital. Businesses having trouble qualifying for a traditional business loan may be more likely to qualify for an MCA. Maximum borrowing amounts, repayment terms, and fees are not disclosed on PaymentCloud’s site, so you’ll have to contact the company for further details.

PaymentCloud Fees, Rates & Pricing

Very little specific pricing information can currently be found on PaymentCloud’s website, other than a statement that rates start at 0.15%. This practice is common among many merchant account providers, especially those serving high-risk sectors.

Prices are highly variable and will differ from one merchant to the next, depending on your business’s type, processing history, sales volume, credit history, and other factors.

Pricing Overview

| Item | Value | | Pricing Starts At | Not disclosed |

| Contract Length | Varies |

| Processing Model | Flat-rate, interchange-plus, tiered |

| Card-present Transaction Fee | Start at 0.15% |

| eCommerce Transaction Fee | Varies |

| Keyed-in Transaction Fee | Varies |

| Equipment Cost | $0+ |

Although specific rates are not disclosed, PaymentCloud offers flat-rate, tiered pricing, and interchange-plus pricing models.

Regardless of what you’re initially offered, we strongly encourage you to obtain an interchange-plus quote, if possible. Most merchants will save money in the long run with interchange-plus, and you’ll also have a better idea of how much your provider charges you over the interchange costs that are part of any credit or debit card transaction.

PaymentCloud does not charge the following fees:

- Application fee

- Account setup fee

- Gateway setup fee

- Annual fee

- Monthly minimum

- PCI compliance fee

- Statement fee

Mid-To-High-Risk Pricing

Whatever the reason you are high-risk, expect your processing rate to be higher and much more variable than those offered to low-risk merchants, depending on several factors. Additionally, the higher your risk, the higher the probability you’ll need to accept a tiered plan. You may still be eligible for interchange-plus pricing with PaymentCloud, so we strongly suggest investigating this option.

You’re also likely to have a monthly minimum, a strict processing limit, and a rolling reserve account established with the acquiring bank to help mitigate your risk. Beyond this, you still won’t be charged a PCI compliance fee, annual fee, application fee, or other junk fees. High-risk merchant accounts require a more extensive underwriting and onboarding process than other businesses, so it’s particularly commendable that PaymentCloud doesn’t charge an application fee for these clients.

With the extreme rate variation that you’ll encounter in high-risk processing, a good final piece of advice is to get a handle on your effective rate. This rate includes your monthly fee, monthly minimum, and any other costs besides your main processing rate.

Sales & Advertising Transparency

Your first impression of PaymentCloud will likely come from its website, which has a professional appearance and is easy to navigate. Unfortunately, you won’t find specific pricing disclosures. However, you’ll find extensive information about credit card processing and setting up a merchant account. You’ll also find detailed explanations of accepted industries and why those particular business types are classified as high-risk.

In speaking with PaymentCloud about some issues with the website, I learned that a complete redesign is on the horizon, so we’ll keep an eye out. However, what we’d like to see is more pricing transparency. While we’re more lenient in this regard for high-risk providers due to the inevitable rate variation, we’re still looking for good educational materials about pricing structures and the types of fees you’ll encounter — anything that publicly indicates PaymentCloud is open and honest about costs, even for high-risk merchants.

PaymentCloud uses both an in-house sales team and independent sales agents to market and set up new accounts. While independent agents in the processing industry have a poor reputation for high-pressure sales tactics and deception regarding contract terms and fees, there are currently no patterns of complaints about the company’s sales practices to be found in online PaymentCloud reviews posted by users. This indicates to us that PaymentCloud provides good supervision and tracking of its independent agents.

PaymentCloud has a fairly extensive social media presence, with accounts on Facebook, X (formerly Twitter), Instagram, and LinkedIn that are all frequently updated. There’s also a YouTube channel with an extensive set of educational videos that explain the ins and outs of credit card processing.

Contract Length & Early Termination Fee

PaymentCloud doesn’t publicly disclose the Merchant Application or Terms and Conditions sections of its contracts. Different contracts are likely used depending on which processor and bank you’re set up with, so expect some variation in contract terms. High-risk merchants need to carefully read and understand every word of the contract, including the fine print!

Low-risk accounts are set up on month-to-month plans with PaymentCloud. You should also receive a copy of a signed waiver of any early termination fee (ETF) that comes with the standard contract from your back-end processor. The ETF is a fee (usually about $300-$600) that you’d have to pay if you breach your agreement by closing your account before the end of the contract term.

High-risk merchants are typically required to sign long-term contracts with any merchant account provider. Apparently, some high-risk merchants are eligible for month-to-month plans with certain processors in PaymentCloud’s network, so it doesn’t hurt to ask if this is possible. Otherwise, the standard term for a high-risk account with PaymentCloud is two years (lower than the three-year industry standard). You can also expect an automatic renewal clause that extends the contract for successive one-year periods.

We don’t like ETFs, but as a high-risk merchant, you’ll probably have this fee in your contract. However, you may still be able to get the ETF waived or lowered with PaymentCloud. Just be sure you understand the conditions of implementing this waiver, as some other portion of your deal may be sacrificed in return. If the ETF remains in place, follow the instructions for closing your account to the letter to avoid this penalty if you need to cancel.

Customer Service & Technical Support

Your dedicated account manager is your main point of contact with PaymentCloud. This person acts as your ongoing advocate and negotiator. Having a single point of contact within the company is particularly useful for high-risk merchants, as they often experience a higher rate of technical problems, chargebacks, and other issues than low-risk merchants.

If your account manager isn’t available, you can also reach either the West Coast or East Coast office between 7 AM and 6 PM Pacific Time. For after-hours problems or issues with your bank, processor, gateway, etc., you can use the direct 24/7 tech support lines for those parties. Authorize.Net, in particular, is known for good-quality tech support, which is a big reason PaymentCloud prefers this gateway for its merchants. PaymentCloud itself also provides a general tech support email address that can be used to raise support issues, but you may not hear back until the next business day.

| PaymentCloud Customer Service |

Availability |

| Phone Support |

|

| Email Support |

|

| Support Tickets |

|

| Live Chat |

|

| Dedicated Support Representative |

|

| Knowledge Base or Help Center |

|

| Videos & Tutorials |

|

| Company Blog |

|

| Social Media |

|

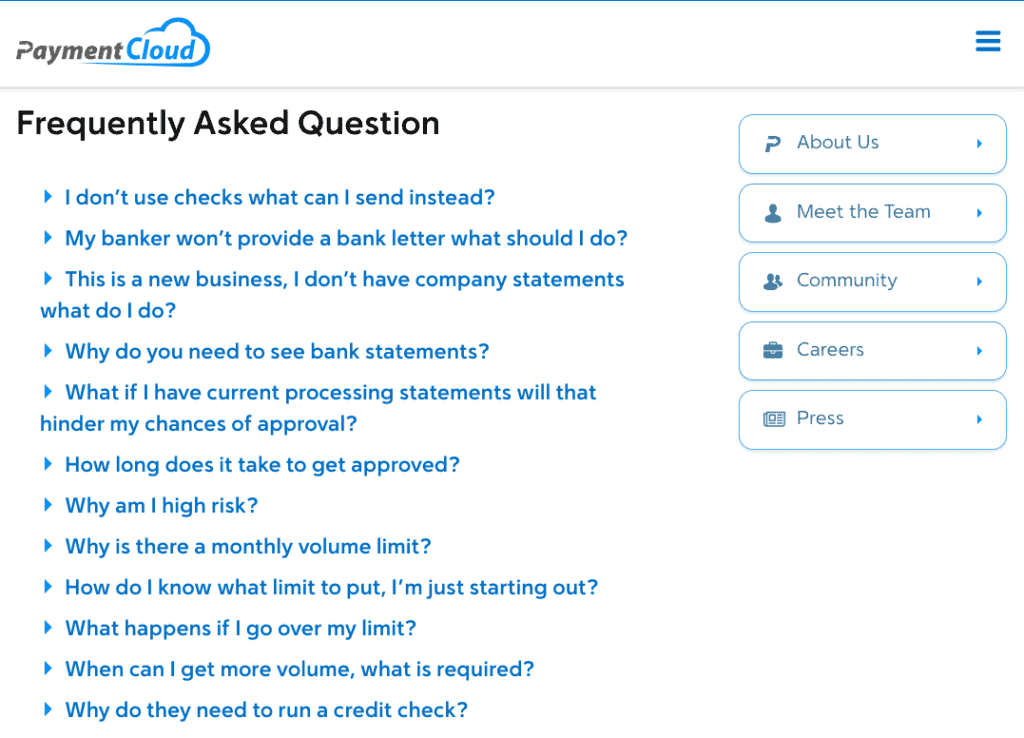

By way of self-help resources, PaymentCloud has an excellent FAQ on its website. The descriptions of individual industries and their common high-risk issues are also helpful. However, we’d still like to see these resources greatly expanded in the future. With a wealth of specialized knowledge and experience in the high-risk and eCommerce sectors, the PaymentCloud website could easily become an invaluable information hub for these merchants.

PaymentCloud Merchant Services Reviews & Complaints

PaymentCloud has mostly positive reviews. As mentioned, PaymentCloud was acquired by Electronic Merchant Systems (EMS) in January 2024. Although we do not rate EMS particularly highly, we have not seen any increase in complaints or negative reviews of PaymentCloud since the acquisition, which is a good sign that PaymentCloud has maintained its same quality of service.

Let’s take a closer look at PaymentCloud’s positive and negative reviews.

Negative PaymentCloud Reviews & Complaints

PaymentCloud has been accredited by the BBB since March 2024 and has an A+ rating. The company has received ten complaints in the last three years, with zero complaints filed within the last twelve months. Unfortunately, almost all of these complaints erroneously accuse the company of withholding funds from transactions. PaymentCloud has responded in good faith to all of these complaints but was unable to resolve them due to the complaining merchants’ stubborn refusal to accept that the company doesn’t have control over this situation.

Let’s be clear: PaymentCloud doesn’t have your money. In fact, it doesn’t get paid either while your transaction is being held. Your back-end processor has your money, and you’ll have to contact that company directly to resolve the issue. Please read our article on account holds, freezes, and terminations to learn how this process works.

On Trustpilot, PaymentCloud has an average rating of 4.7 out of 5 stars based on 695 reviews. While there are a fair number of low reviews, fully 85% of the merchants who responded gave the company a 5-star rating.

Overall, PaymentCloud has less negative feedback than the average merchant services provider, and we found no sign of common problems to watch out for. Scattered complaints with the company’s pricing appear to result from merchants not understanding that high-risk payment processing is inherently much more expensive than it is for low-risk businesses, regardless of which provider you sign up with.

Positive PaymentCloud Reviews & Testimonials

We’ve received a steady stream of (mostly) positive feedback about PaymentCloud from our readers since this review was first published. One commenter praised the company even though it couldn’t place his business, which is almost unheard of in the credit card processing world. While it’s apparent that the company actively solicits testimonials from its merchants, the endorsements we’ve received have all been thoughtful and well-written.

PaymentCloud reviews from merchants typically mention the company’s expertise, transparency, and persistence in assisting high-risk merchants. Customer support is described as prompt, thorough, and easy to work with.

Final Verdict On PaymentCloud

PaymentCloud offers reliable service at a reasonable price. With generally strong praise from customers and recommendations from reputable providers like Dharma Merchant Services and Stripe, we have no problem recommending PaymentCloud for your high-risk business. The company’s main strength is its hands-on advocacy and guidance provided for merchants both during and after onboarding.

PaymentCloud works tirelessly to present high-risk businesses in the best possible light to underwriters while maintaining a sense of transparency that keeps merchants in touch with the reality of their situations. Because PaymentCloud works closely with so many banks and back-end processors, you’ll have a better chance of approval than with many competing merchant account providers.

PaymentCloud scores very well overall, but it’s not perfect. We’d still like to see more pricing transparency for low-risk merchants and more extensive educational materials on the PaymentCloud website. PaymentCloud is an excellent provider for high-risk and eCommerce merchants, but we always recommend that you shop around and compare quotes from several providers before making a decision.

Be sure to check out our favorite offshore merchant account providers if you’re unable to get approved for a domestic high-risk merchant account.

To learn more about how we score our reviews, see our