An offline POS system can help you continue to operate your business, even when the power or the internet goes out.

Our content reflects the editorial opinions of our experts. While our site makes money through

referral partnerships, we only partner with companies that meet our standards for quality, as outlined in our independent

rating and scoring system.

Not every business that accepts credit cards will screech to a halt if the internet goes down. But any business where the vast majority of customers prefer to use their cards knows how important a strong POS offline mode can be. In most instances, the best POS systems offer offline modes that allow your business to keep operating — and in some cases, even keep accepting credit card payments — without an internet connection.

So what happens when the internet goes out at your business?

In this post, we’ll explain offline POS mode, how it works, what the limitations are, and what you need to ask a prospective POS provider before you commit to a contract.

How To Use A POS Offline

Setting your POS to offline mode is almost always a very simple process, no matter your provider.

If you lose internet access, you can toggle your POS to offline mode, which, in most cases, still allows you to use basic functions within your system. You will also still have the ability to take cash payments and card payments that will be encrypted and then processed once internet access is restored.

When Do You Need To Use Your POS Offline Mode?

While you generally will want to use your offline mode sparingly for security reasons and to process payments as quickly as possible, here are a few situations where it might be necessary.

- Brief internet outage: If your network or WiFi goes down while you have customers in the store, you don’t want to inconvenience them by trying to diagnose the problem as they wait. Instead, you can simply switch to offline mode, conduct business as normal, and process those payments when the internet is fixed.

- Employees who travel: If you have employees who are out and about, the internet may be patchy or unpredictable. Switching to offline mode in remote or rural areas can ensure that payments can still be received.

- Selling outside: If you are a vendor who operates in a mobile food truck or at farmer’s markets, you might encounter situations where the location you’re at for the day or the weekend has poor internet. Offline mode can be a lifesaver in these situations, allowing you to sell like normal.

How Does A Payment Process With A POS Offline?

Support for credit card processing in a POS offline mode depends on several factors. It’s not a guaranteed feature of every POS system with offline mode, but for those who do have it, offline credit card processing can be a huge benefit. A major consideration for small businesses that are setting up their POS system and credit card processing is whether to use an integrated setup or keep the two as standalone services.

While there are still a fair number of businesses that use standalone credit card processing with another POS system, integrated payments and POS software allow for better data collection and less work managing transaction information overall.

If your POS and payment processing are not integrated, but your POS system supports offline mode, you will need to make sure that your credit card processing setup also functions offline. Otherwise, you will be restricted to cash and any other POS-supported payment types.

If you do have an integrated setup for your credit card processing and POS, you’ll need to make sure that the offline mode features include support for card payments. Additionally, you’ll need to verify which types of card payments (and which card readers or credit card machines) are supported.

Do You Need An Offline POS?

Not every business needs a point of sale system with a strong offline mode, but for many, it can create a lot of peace of mind and protect profits. Obviously, if you are operating in an area with even somewhat sketchy internet connectivity or if you operate a mobile business, having an offline mode that can continue to store your data and accept transactions is a must.

Also, if your business primarily accepts card payments as opposed to cash, having a point of sale system without an offline mode is going to bring your sales to a halt until service can be restored. Even if you rarely have an internet outage, a delay can cost you dearly if you don’t have a backup. If you run a busy cafe, for example, with hundreds of customers who are in and out quickly with their purchases, even a brief delay in your ability to accept card payments could cost you hundreds of dollars.

In short, strong offline functionality in a POS can be more than just a nice perk; it can be a huge time and money saver.

How Secure Are Offline POS Payments?

Running an offline credit card payment does come with some risks and drawbacks.

First, there’s no way to verify whether an offline payment will go through when the system comes back online. When a credit card is swiped, dipped, or tapped at a credit card terminal with an internet connection, the payment information is routed in real-time directly to the customer’s bank, which gives a quick approval (or decline, if funds aren’t available).

The funds are released later and are eventually deposited in the merchant’s bank account a couple of days after that.

With an offline transaction, that initial approval request isn’t sent until the internet connection is restored. That means a merchant could run an offline transaction, allow the customer to leave, and find out later the transaction has been declined for any number of reasons.

POS systems and credit card processing companies that support offline payments make no guarantees or offer any sort of insurance or protection against loss, so if you intend to run offline payments, be aware that you are accepting the risk.

The second concern is whether it’s even safe to store credit card information in an offline transaction. The good news is that as long as you are following PCI compliance guidelines, processing an offline credit card payment does not in any way compromise your customers’ card information. The credit card reader or terminal reads the card data and encrypts it immediately. That information can only be decrypted when it is sent to the credit card processing company.

How To Find The Best Offline POS

The best POS offline mode systems should be able to still grant you access to your cash drawer and accept and encrypt card payments until the internet is restored. They should also allow you to access things like your customer database and inventory information.

There are plenty of options for the best POS systems with offline mode, but not all of them are equipped with an offline mode that will keep you running smoothly in the event of an internet outage.

Here are some of our favorite POS systems for small businesses with offline mode.

Square Offline Mode

Square makes it exceptionally easy to access and utilize its offline mode. In the case of an outage, you can open the Main Menu on Square Terminal or go to More on Square Register and other Android or iOS devices. From there, you can tap Settings, then Checkout, then Offline Mode, and switch it to On.

Square Terminal is currently the only piece of Square hardware that can accept all forms of card payments, including contactless payments, in its offline mode. Register and Square Magstripe Reader can take swipe payments. Payments are automatically stored and encrypted until internet service is restored. The default mode for the maximum dollar amount that can be accepted in offline mode is $100, but it can be changed to up to $50,000.

Square POS has a reputation for making things easy. It has an intuitive interface, affordable pricing (it set the standard as one of the first free POS systems available), and excellent hardware options. Square also scores points for allowing customers to pay on a month-to-month basis, never locking you into a long-term contract.

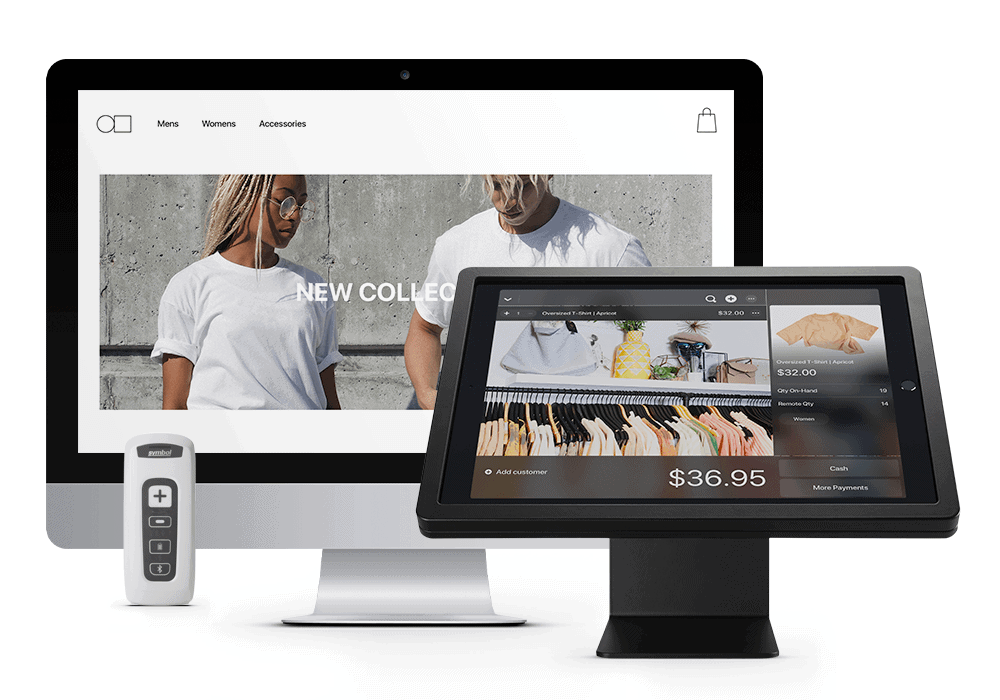

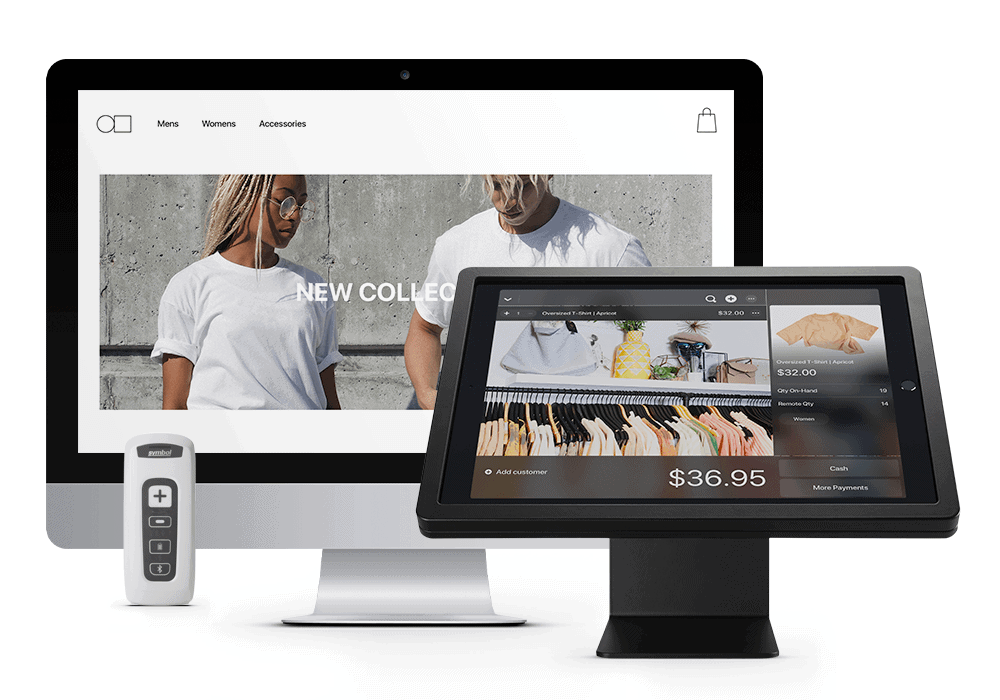

Lightspeed Offline Mode

Lightspeed is an excellent point of sale company that offers both Lightspeed Retail and Lightspeed Restaurant, depending on your business model. However, Lightspeed is also perfect for niche businesses, offering the best POS systems for golf courses, too. Both feature a strong offline mode that kicks in automatically when the internet is down. This gives you basic functionality to keep your business up and running, although not all services will be available.

With Lightspeed’s offline mode, you’ll still be able to take orders, open orders, and print as long as your local network is still active. Payments made during this time are stored in a cache on the register and will back up to the cloud once internet service returns. Back-end features like reporting and sales histories are not accessible in offline mode.

Lightspeed is an all-in-one POS product that is perfect for nearly any sized business with upfront pricing and a rich feature set, including deep reporting and excellent employee management. It is also one of the best POS systems for inventory management. They also feature their own payment service and eCommerce platform.

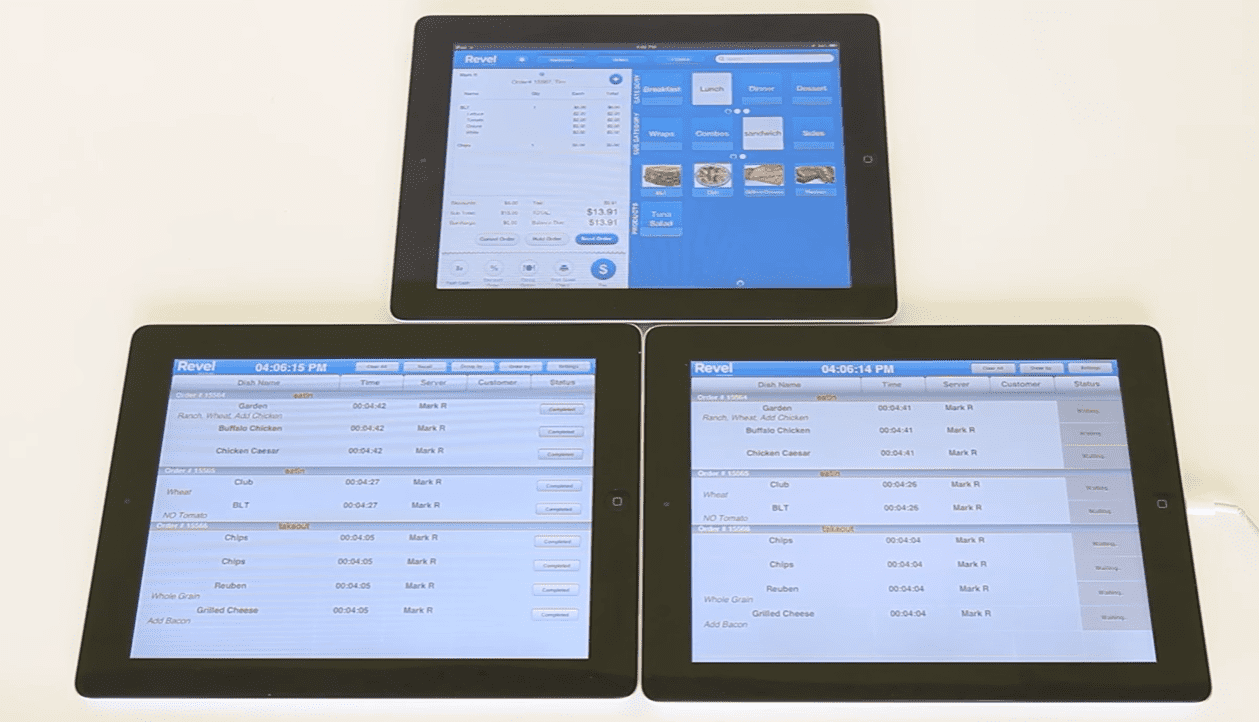

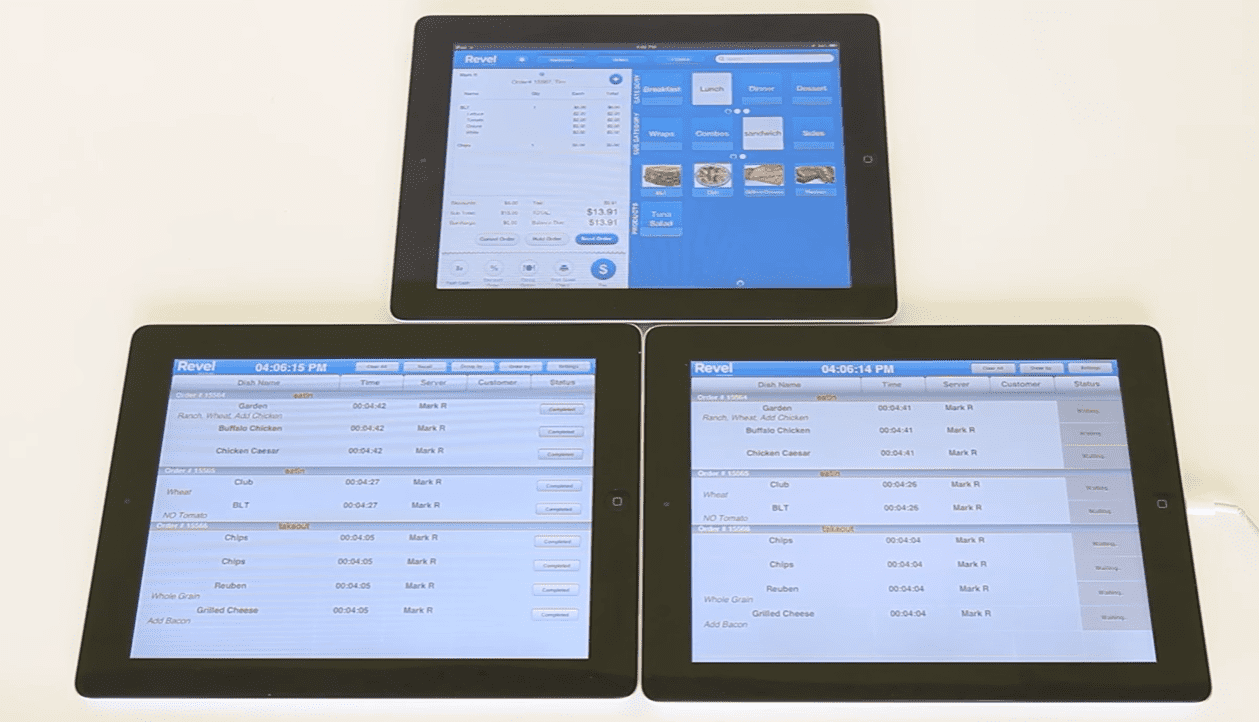

Revel Offline Mode

Revel Systems calls its offline mode Always On mode and, similar to Lightspeed, it automatically kicks in when you have lost an internet connection. This allows users to continue to take payments with those payments being stored until service is restored. One of the more beneficial aspects of Revel’s offline system is how easily you can customize your alerts.

If you type “offline” in the search tab, you can check the box to be notified if your POS has gone offline. From the same tab, you can also enable your system to accept card payments, ask customers to show their information for added security, and display a warning about the payment being accepted while offline. You can also create a threshold for offline payments.

Revel is a POS system designed for larger businesses, as it has an incredibly robust feature set and some of the most extensive backend offerings on the market. While the system can take some time to learn, it has everything you would expect from a high-level point of sale system.

Toast Offline Mode

Toast is a popular and complete system and is one of the best point of sale systems for restaurants. It also comes with a robust offline mode that is simple to set up. You can activate Toast’s offline mode capabilities at any time. Then, when you lose internet connectivity, your system will automatically still maintain the ability to take card payments. To do this, simply navigate to Payment Settings and toggle Offline Mode to On.

Toast has some additional security features set up in its offline mode. Employees must have the appropriate permissions set to accept offline payments. Also, other Toast functions, like the system’s Kitchen Display System, will not operate without an internet connection. Like most other offline mode functions, transactions are stored and encrypted and then processed once the internet is restored.

Toast is an all-in-one restaurant point of sale system that is particularly strong when it comes to mobile ordering. The company has its own payment processor and is well known for its excellent customer service.

Final Thoughts

Most of the best mobile point of sale systems come with at least some form of offline mode now, but the effectiveness of their offline modes can vary. Needless to say, it’s nearly an essential feature if you run a fast-paced business that has a high number of transactions each day. Strong offline modes can keep your business functioning almost like nothing happened during an internet outage, allowing you to take card payments and store them securely until a connection is restored.

If you’re on the fence about what point of sale system to purchase, its offline capacity could function as a tiebreaker. It definitely shouldn’t be a feature that you feel you have to sacrifice, as there are plenty of strong POS options available to you.