Level Up Your Business Today

Join the thousands of people like you already growing their businesses and knowledge with our team of experts. We deliver timely updates, interesting insights, and exclusive promos to your inbox.

Join For Free💳 Save money on credit card processing with one of our top 5 picks for 2025

Shopify's built-in payment processing feature allows you to accept credit card payments, and could be a money-saving addition to your Shopify store.

Shopify is a popular commerce platform that offers a wide variety of sales tools and services to businesses. The Shopify ecosystem is gigantic, potentially serving as a one-stop shop for online stores, POS hardware, inventory management, staff management, and more.

For this post, however, we’re going to focus on one important part of Shopify’s infrastructure: its role as one of the best credit card processing companies. Welcome to our deep dive into Shopify Payments.

Table of Contents

Shopify Payments is Shopify’s built-in payment processing feature, which allows you to accept credit and debit cards, as well as additional payment methods. By default, Shopify Payments is a white-label version of Stripe and shares most of Stripe’s strengths and weaknesses.

Merchants using Shopify aren’t required to use Shopify Payments as their processor. It’s possible to plug a different service into the app, but this can come with added costs and inconveniences.

If your business is eligible for Shopify Payments, it just takes a few steps to set up your account. For the purposes of this guide, we’re assuming that you already have a Shopify account and store set up.

One thing to note is that you may be asked to verify your identity while using Shopify Payments. When this occurs, your payouts may be on hold, but your store and ability to process payments should remain active during that time.

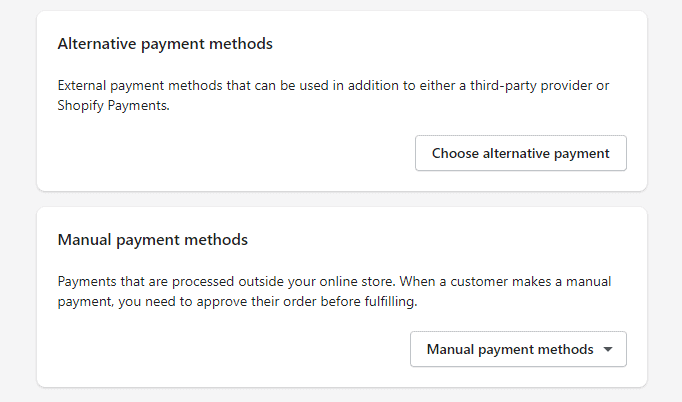

It’s possible to add additional payment method options without replacing Shopify Payments. This doesn’t require any additional fees upfront. You also only pay the transaction fees for the gateway the transaction used, so you won’t be double-billed.

Shopify breaks these payment methods down into alternative payment methods and manual payment methods.

Shopify makes the process fairly straightforward. Popular payment methods like PayPal and Amazon Payments get their own interfaces. You can find other major payment methods, such as Alipay, under the Alternative payment methods block. Just follow the instructions for the selected payment method. Transaction fees vary by payment method.

Manual payment methods are methods not covered by any other category. These include cash-on-delivery, money orders, and bank transfers. There’s no transaction fee for a manual payment method. Instead, the order is marked unpaid until you manually mark it as paid.

The cost of Shopify Payments is based on a number of factors. The good news is that Shopify waives the typical 0.5%-2% commission charge if you use Shopify Payments to process your transactions. Shopify Payments charges a flat rate for all transactions.

Here’s where it gets a little confusing. While there’s no monthly fee specifically for Shopify Payments, your Shopify plan will affect the amount you’re paying for transactions.

One of the advantages of Shopify Payments being powered by Stripe is that it inherits Stripe’s multi-currency transaction support. This feature has the potential to open new markets for your products.

You can enable Shopify’s multiple currency converter by going to Settings > Payments and clicking on Manage in the Shopify Payments section. Under Countries/Regions, select and add the country or region you want to sell to. You can then add a currency selector through Shopify’s Geolocation app or a third-party solution. This allows a customer to see prices in their local currency.

By default, you’ll get paid on any business day after your funds have cleared bank transfer. These are the timelines by territory:

Shopify Balance makes it easy to manage your revenue within the Shopify ecosystem. It can also grant you faster access to your money than you’d get with a standard bank transfer — typically within one business day.

You can set up your Shopify Balance account through Finances > Balance. Select Open Account, enter the requested information, and go through the necessary agreements to set up your account.

To add or edit your bank account for billing purposes, go to Finances > Billing. Under Payment Methods, select Add Payment Method. Select Bank Account and enter your information. Finally, select Start Verification. Once verified, Shopify will debit your bank account for Shopify fees.

If you’re using Shopify Payments, you don’t need to do anything more. In fact, your money will never really be in Shopify. Shopify Payments –or whatever processor you use in place of it — routes your sales money to a merchant account where transaction fees will be deducted from your sale. Then, your money will be automatically routed to the bank account connected to your payment processor.

The exception to this is Shopify Balance, which replaces your bank account in the payment process. Once you’ve enabled Shopify Balance, your Shopify Payments deposits will be routed there instead of to your bank account. You can still switch back to your bank account. You can also transfer funds from your Shopify Balance account to a bank account by going to Finances > Balance > Move Money. Find Transfer Funds From Balance, and enter the appropriate account details.

Shopify Payments inherits Stripe’s restrictions on the types of businesses that can use it. Certain industries and products are considered “high-risk” due to being associated with a higher rate of chargebacks and fraud. Third-party processors like Stripe and Square aggregate businesses into a single merchant account, so they tend to be very strict about keeping high-risk businesses off their networks.

You’ll need to select an alternative payment processor if your business falls into one of these categories.

| Prohibited Category | Definition | Examples Of Prohibited Businesses/Activities |

|---|---|---|

| Financial and professional services | This covers businesses that deal directly with investments, credit, or legal services | Credit counseling, bail bonds, financial institutions, check cashing, digital wallets, virtual currency |

| IP Infringement, regulated or illegal products and services | This covers vice-related businesses, as well as those engaged in illegal commerce | Pornography, sexually-oriented services, gambling, counterfeit goods, cannabis, businesses/countries under sanction |

| Products and services prohibited by law or Shopify’s financial partners | This overlaps with some of the previous categories, along with some additional businesses considered high-risk by Shopify’s partners | Nutritional supplements, social media activity services, multi-level marketing |

| Unfair, predatory, or deceptive practices | This covers businesses with dubious ethics | Get-rich-quick schemes, mug shot publications, resale of government offerings |

Note that this list applies specifically to U.S.-based businesses. While the prohibited list is nearly identical between nations and territories, there are some differences in the terms of service.

Shopify Payments provides a user-friendly, fully integrated way to take payments through Shopify. Even better, it offers the ability to add additional payment gateways like PayPal and Amazon Pay at no additional cost. Remember that you’re not obligated to use Shopify Payments as your primary processor, although using a different one comes with an additional transaction fee.

Get in touch with a real human being on the Merchant Maverick team! Send us your questions, comments, reviews, or other feedback. We read every message and will respond if you'd like us to.

Reach OutGet in touch with a real human being on the Merchant Maverick team! Send us your questions, comments, reviews, or other feedback. We read every message and will respond if you'd like us to.

Reach Out

Let us know how well the content on this page solved your problem today. All feedback, positive or negative, helps us to improve the way we help small businesses.

Give Feedback

Want to help shape the future of the Merchant Maverick website? Join our testing and survey community!

By providing feedback on how we can improve, you can earn gift cards and get early access to new features.

Whether you're looking to save money on processing or to get approved for a merchant account, PaymentCloud can help.

Get Started

Whether you're looking to save money on processing or to get approved for a merchant account, PaymentCloud can help.

Get Started

Help us to improve by providing some feedback on your experience today.

The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation.

Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication. Merchant Maverick’s ratings are not influenced by affiliate partnerships.

Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are author’s alone.

Whether you're looking to save money on processing or to get approved for a merchant account, PaymentCloud can help.

Get Started

Whether you're looking to save money on processing or to get approved for a merchant account, PaymentCloud can help.

Get Started