Learn to identify and understand the various fees on your statement, including transaction fees, monthly fees, and any hidden charges that could be impacting your bottom line.

Here at Merchant Maverick, we’ve received countless questions over the years from concerned business owners regarding their merchant account statements. In fact, our website owes a large part of its very existence to the complex pricing, convoluted statements, and hidden markups that are hallmarks of the card processing industry. This is the unfortunate state of affairs that keeps us researching, writing, and advocating for small business owners.

Questions we frequently field from our readers about their processing bills include:

- Am I paying too much for card processing? (That’s the big one everyone wants to know!)

- Why did my processing costs suddenly go up this month?

- What is this unexpected/oddly-named/junky-looking fee? Is it legit?

- Is there anything I can do to lower my costs without changing providers?

- Should I change account providers?

Only a thorough understanding of your own statements will yield the answers to these important questions. The inherent difficulty of the task is that you can’t completely rely on your provider’s statement guide, nor its sales or customer service reps, to explain all the fees. If your account provider is being sneaky about extra markups and unnecessary fees, the responsibility falls directly on you to decipher what’s really going on.

There’s no one-size-fits-all method for analyzing a statement because every business and situation is a bit different. Still, there are definitely some foundational concepts that should help demystify the process. For example, here’s one quick tip to kick things off: Examine more than one statement side-by-side to avoid missing anything. Often, you need two months of statements just to completely view one month’s worth of charges. So, grab at least two or three consecutive statements and let’s get started!

Details vs. Big Picture

Analyzing a processing statement is always a balancing act between the details and the big picture. If you’re worried about a questionable charge, or suspect you’re paying too much overall, you may need to check every fee on your statement to identify its source and confirm the amount is what it should be. I’d encourage all merchants to at least give this a try on a few statements. If anything, you’ll verify that the fee schedule from your merchant agreement was implemented as you expected.

On the flip side, you actually needn’t worry too much about all the individual fees and rates on your statement if you track the big-picture numbers (your overall costs) month-over-month. As long as the big-picture amounts remain reasonable and consistent, you’re pretty much good to go. If they do change significantly, though, you’re back to looking at the details of your statement to figure out why. Fortunately, if you’ve already mastered the baseline details of your statements, you’ll easily identify the culprits that are most impacting your costs.

In short, understanding the interplay of your big-picture numbers (what you’re paying overall) and detailed costs (why you’re paying it) is the best way to protect yourself from paying too much.

With that bit of philosophy out of the way, let’s look at the main big-picture percentage that all merchants can calculate.

Calculating Your Effective Rate

Your effective rate is the “all-in” percentage rate you’re paying for the privilege of accepting card payments. All business owners should take a first crack at calculating this rate before conducting any detailed analysis. It’s a simple formula:

(Total monthly fees / Total monthly sales) x 100 = Effective Rate

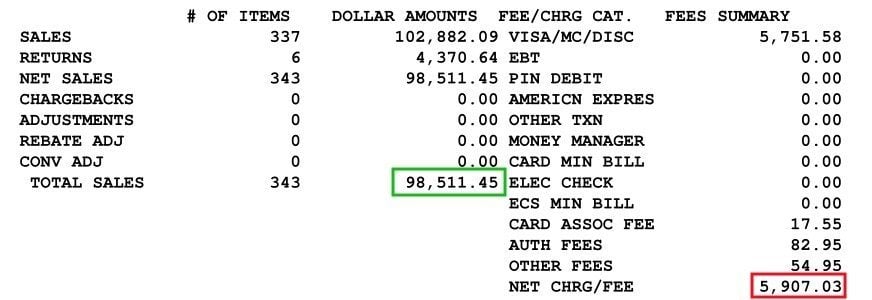

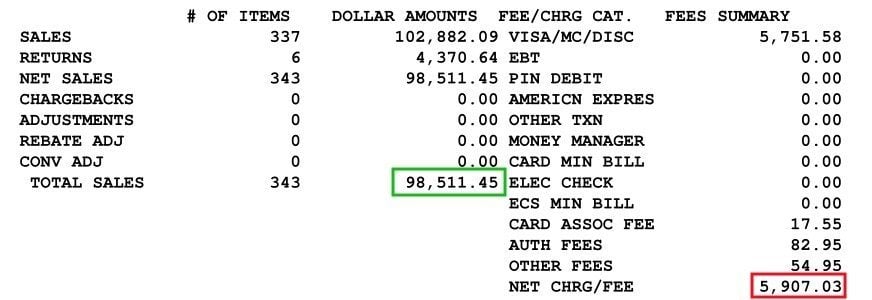

By total monthly fees, we mean processing charges, gateway fees, statement fees, monthly fees, equipment leases, weird fees you can’t figure out — everything. Sometimes you can grab these numbers from a summary section, as below:

$5,907.03 / $98,511.45 = 0.0599, or an Effective Rate of 5.99%

I still always recommend calculating your effective rate again once you’ve analyzed your statement in full. That way, you can ensure your summary section didn’t sneakily omit any charges. You’d be surprised how often this happens. (Or, maybe you wouldn’t be!)

Your effective rate provides a basic answer to “How much am I being charged for card processing?” and “Am I paying too much?” The precise answer to that second question is, of course, more nuanced for each business. For a large retail corporation, a 2.5% effective rate might be too high. For a high-risk eCommerce operation with lots of small transactions, 4.5% might be a screaming deal. Even with this variation, however, the effective rate gives you an important bird’s-eye view of where you stand.

Types Of Credit Card Processing Fees

You’re probably already aware that there are multiple layers to the card processing industry. Not surprisingly, each entity involved takes a cut of your card sales in one form or another. Here, I’ll go over the main players in the industry, and whether they each charge wholesale costs (fixed throughout the industry) or markups (variable and negotiable depending on your business situation and account provider).

Wholesale

- Card Networks: We’ve all heard of these folks — Visa, Mastercard, and the like. These associations take their cut of processing costs in the form of card association fees and assessments. If you don’t think you’d be able to recognize these charges on your statement, head over to our card brand fee article for an explanation and full reference list.

- Card-Issuing Banks: The banks that have issued credit and debit cards to your customers charge interchange fees — the cost of running each individual type of card and transaction. The card associations actually set these fees for the issuing banks, and also publish and frequently update lists for merchant reference.

Not everyone will be able to see pure wholesale costs on their statements. This is because sometimes wholesale costs are passed through directly to merchants, while in other cases they’re blended in with markups. This mostly depends on your pricing model (we’ll have a section on that topic coming up).

Still, regardless of what “should” be happening with wholesale charges according to your pricing model, it’s worth checking to see if any have been passed through to you, and if the amounts are correct. Interchange fees are usually pretty easy to spot — they’re typically in a giant itemized list if you can see them at all. Card brand fees can be more difficult to identify, so definitely consult a reliable reference list.

Markup

Everything besides those two types of wholesale fees we’ve just discussed counts as a markup. Here are the main players that add costs above wholesale:

- Processor/Acquirer: You may know some of the big ones — First Data, TSYS, Vantiv/Worldpay, Chase, Elavon, etc. These entities are also usually involved with an acquiring bank (e.g., Wells Fargo or B of A) if they aren’t already one themselves. The processor behind your merchant account can add its own extra fees and markups.

- Merchant Service Provider (MSP): This is the entity that actually sets up and manages your merchant account — the company you interface with most directly. You also access your monthly statements through your MSP, even though the statement might have the big processor’s name across the top. You may have signed up for your account with the MSP department of one of the large processors we’ve already mentioned, or you may have used a separate MSP/ISO that has teamed up with one or more processors to provide accounts. Regardless of the setup, your merchant services provider adds its own markups as well.

- Additional Service Providers: Charges from other third parties (such as gateway or processing equipment providers) may also show up on your merchant account statement.

A word of caution about “pass-through” fees: Just because your MSP claims to be merely “passing through” a fee to you “at cost,” doesn’t necessarily mean it’s a wholesale charge (from the card associations or card-issuing banks). As you can see above, the big processor/acquirer behind the scenes may also charge its own fees and markups, and often other third-party equipment and software providers do as well. These “pass-through” fees should be counted as variable markups, even though your MSP may not see any money from the charges.

Calculating Your Effective Markup

If you can see all interchange fees and card brand fees (wholesale costs) itemized on your statement, you can calculate your effective markup. Let’s take a look at what this is, and why it’s an advantageous number to crunch if you can swing it.

Remember, the markup is the piece that varies between MSPs. Not only can the overall amount vary widely, but the way markups are charged is also variable between providers. For example, one MSP might charge a low markup percentage on your individual transactions, but several different monthly fees as well. Meanwhile, another MSP might charge a high markup percentage on transactions, but hardly any monthly fees. Which one’s a better deal? This is why it’s good to know your markup as an overall percentage.

Your effective markup not only lets you know how much you’re really paying in controllable costs each month, but it’s also a handy figure to have if you’d like to compare your statement with other merchant account offers.

Here’s the basic formula (always multiply by 100 to convert to a percentage):

Markup Fees / Total Sales = Effective Markup

Depending on how your statement is laid out, here’s another way to think of the calculation that might be more helpful:

[Total Fees – (Interchange Fees + Card Brand Fees)] / Total Sales = Effective Markup

I like this second way because it’s a clear process of elimination. Once you’ve got all the wholesale fees accounted for and subtracted away from your total fees, you automatically know everything else you’re charged is a markup.

You might have a summary section on your statement that divides up your fees in such a way to make this calculation simple. It’s more likely, however, that you’ll have to pick through your statement to make sure you understand your pricing structure and the true classification of each fee before you can add up the numbers and perform the effective markup calculation with confidence. Call me paranoid, but I have a mistrust of so-called “summary” sections on statements. Been burned way too many times!

What if you can’t calculate your effective markup at all, because your statement doesn’t make it possible to see all wholesale fees separately? That’s fine — just focus on tracking your effective rate for now. It’s not as telling a number as your effective markup, but it’s an excellent starting point for staying on top of your costs.

Identifying Your Pricing Model

Knowing your pricing model is absolutely critical to understanding your statement, so if you don’t already know it, now is the time to figure it out!

We’ve already alluded to the fact that your pricing model determines whether or not you can distinguish wholesale costs from markups. You’ll never know exactly where you could be saving money (or where you’re getting ripped off) if you can’t make this distinction.

This is a complicated topic, so it may take you a while to wrap your mind around which model you have and how it impacts your statement. That’s okay — take your time. We do also occasionally come across some interesting hybrid models, so if you still need assistance figuring out your model, feel free to reach out to us.

So, how do the pricing models work? Well, the models were developed based specifically on interchange fees and whether or not they are blended in with MSP rate markups. (Card brand fees are not tied as tightly to your pricing model, so I’d just recommend checking your own statement to see if any are passed through.) Below are links to articles on each of the models, as well as a super-brief overview of each.

Interchange separate from markup:

- Interchange-Plus (Cost-Plus) Pricing: Interchange rates are itemized and passed through separately from the MSP markups. Rate markups typically include a percentage markup and a per-transaction fee markup.

- Membership (Subscription) Pricing: A version of interchange-plus pricing in which a monthly membership fee is charged as a markup in lieu of a percentage markup over rates.

Interchange blended with markup:

- Tiered Pricing: Interchange rates are blended in with markups to create multiple rate tiers.

- Flat-Rate Pricing: Interchange rates are blended in with markups to create a flat processing rate (most often used by merchant aggregators like Square, Stripe, and PayPal — not traditional MPSs).

In theory, you should be able to calculate your effective markup if you have one of the first two models, because wholesale fees are kept separate. This is one reason we favor MSPs that offer transparent interchange-plus or subscription models to all merchants. For the other two blended plans, you’ll need to stick to monitoring your effective rate only.

Identifying Your Billing Cycle & Billing Method

Beyond understanding your pricing model, you should be aware of exactly when you’re charged the various fees and rates due on your account. A closer look at your billing cycle could potentially reveal that you’re not calculating your effective rate properly, or that you’re paying higher processing rates than you originally thought. Here are a couple of tricky billing methods to watch out for:

Daily Discount (vs. Monthly Discount)

“Discount” here refers to your card processing fees (as opposed to scheduled monthly fees). Your discount method is totally irrespective of your pricing model. Most merchants are on a monthly discount plan, meaning their discount fees are all charged in one lump sum at the same time as the rest of their scheduled monthly fees. In other words, you receive gross deposits from your batch settlements throughout the month, and then pay all your discount fees along with all other scheduled fees all at once.

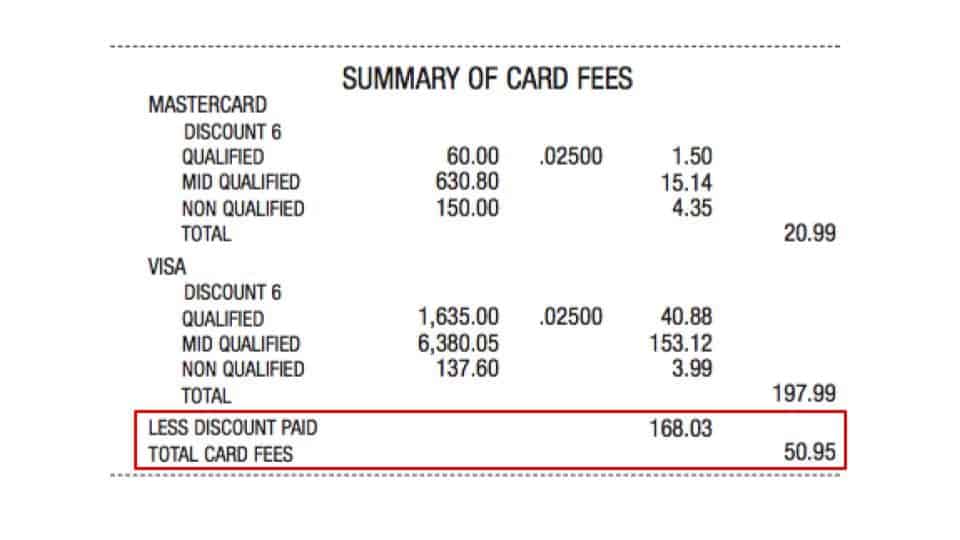

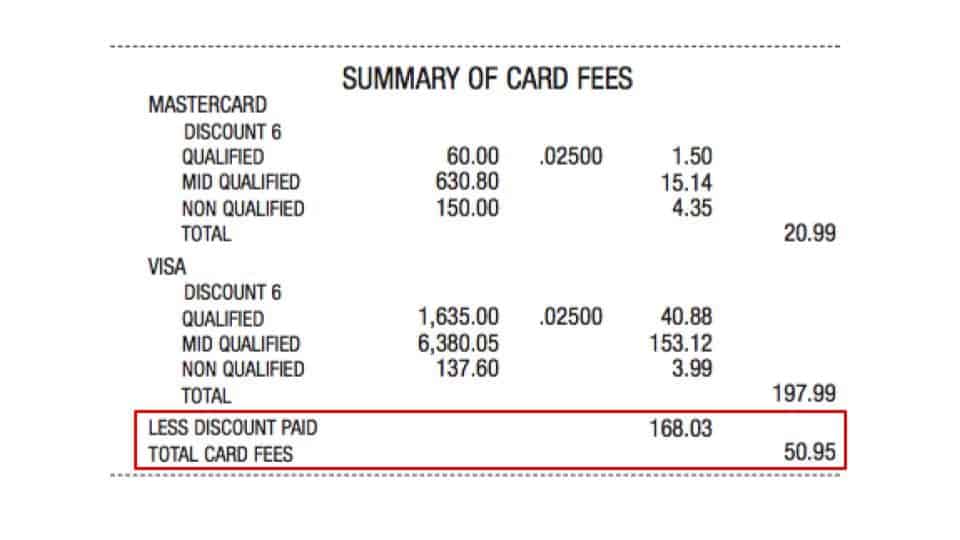

On a daily discount cycle, your discount fees (or a portion of them) are deducted from each batch settlement as the month progresses. This leaves you with net deposits from your batches, and all your other scheduled fees are charged in a separate chunk. You can often tell if you are on a daily discount cycle if your statement contains terms like “less discount paid,” or shows net versus gross amounts in sales columns. With daily discount, you must be careful to add the discount fees you’ve already paid throughout the month to the other monthly fees you still need to pay. Don’t be misled by the “total charges” figure, which may not include the discount fees you’ve already paid.

Add together the “less discount paid” of $168.03 and “total card fees” of $50.95 to find the actual amount that is paid for the month: $218.98!

Billback

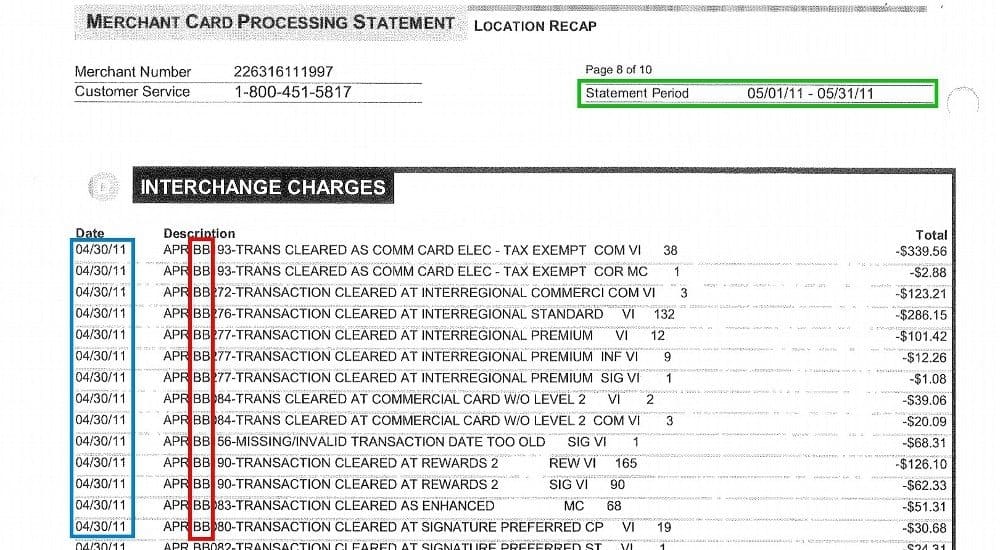

Billback is a rolling billing method that is technically different from (but often combined with) both a daily discount setup and a tiered pricing model. On a normal tiered plan, you’re charged the different rate tiers (qualified, mid-qualified, non-qualified) for your transactions all in the same month. With billback, however, you are charged the qualified (lowest possible) rate for all your transactions first, but then charged a fee the next month to recoup all the extra cost for any higher-tiered transactions you ran.

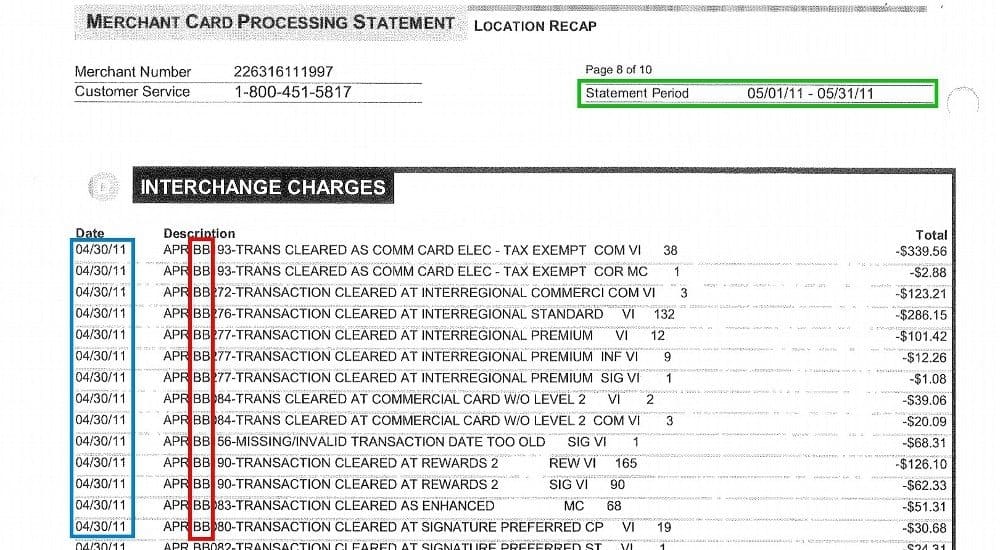

With this rolling system, you actually need two months of statements to even calculate your effective rate for a given month, since your charges for one month are split over two months — possibly more. Even worse, the Enhanced Billback method (a.k.a. Enhanced Recovery Reduced) adds an additional markup to the next month’s recouping fee. You may see BB, EBB or ERR abbreviations (along with a past month’s abbreviation) listed on your statements if you’re in a billback situation, but you may just need to spot the extra fees on your own.

Billback statement: Extra fees for April transactions charged in May.

Nitty-Gritty Numbers

As we discussed at the beginning of the guide, you needn’t identify every fee every month into eternity, but I’d strongly recommend going for it on a few statements. Maybe you’re just curious and would like to become a more cost-savvy merchant, or maybe you suspect a hidden fee, or maybe your processing bill has spiked lately and you want to know why. Not to mention, sometimes statements contain run-of-the-mill mistakes that need catching! After all, not all MSPs are pure evil. Just most of them.

Of course, I can’t tell you every fee you’ll ever see on a statement and whether it’s legit. What I can do is offer you a few general tips I’ve found helpful as I’ve analyzed statements:

- Identify Percentages vs. Dollar Amounts: Costs may come through as percentages of sales volume, per-transaction fees, or flat fees. At times, half the battle is just confirming which fees are percentages and which are dollar amounts, because they may all be shown in decimal form (and all mixed into the same columns!). The good news is that a quick calculation of your own can usually confirm which are which.

- Use Fee Guides: Absolutely make use of any statement guide from your provider, but also check out an outside resource or two. Our fee guide lists the common fees you’ll encounter on a statement, and our fee infographic shows the typical cost range of many standard charges. I know I’ve said this a bunch of times already, but you’ll also need a good card brand fee reference list to confirm these fixed-yet-esoteric charges.

- Ask Yourself Fee ID Questions: As you work through each charge, see if you can answer the following queries:

- Who charges this fee/rate? (see “Types Of Fees” section above for possible culprits)

- Is this charge a markup, wholesale cost, or a blend of the two?

- Is this wholesale charge correct according to interchange tables or the card brand fee list?

- Is this markup (or blended cost) correct according to my merchant fee schedule from my MSP?

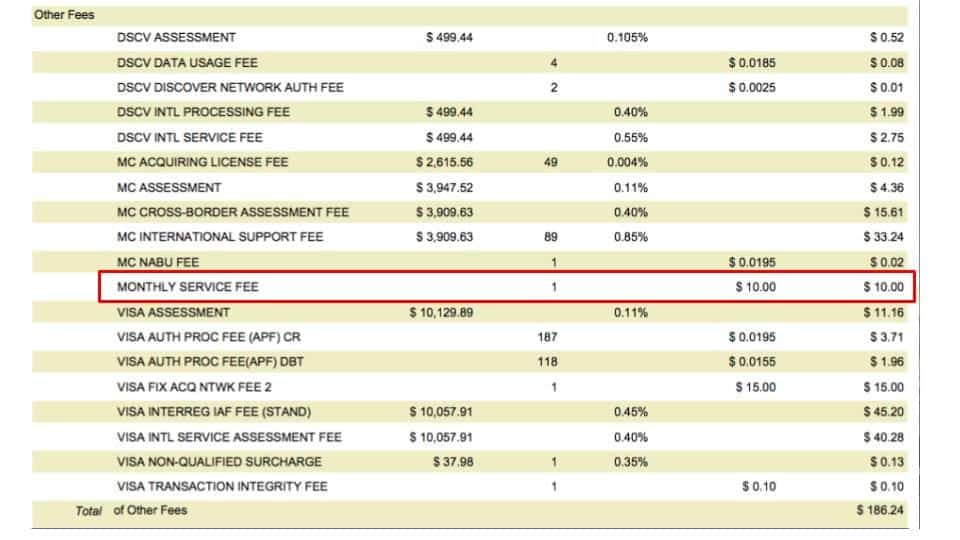

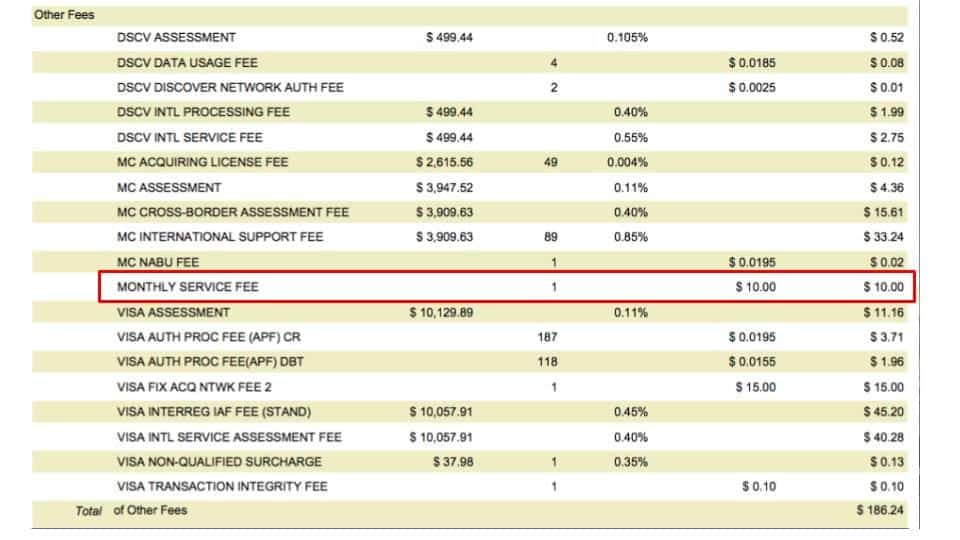

- Don’t Trust The Layout: We’ve dissected some horrifically disorganized statements over the years, which has only confirmed in my mind that you simply cannot rely on the sub-headings on a processing statement to properly categorize your fees. Wholesale fees are very often interspersed with markups and vice versa, so be on your guard. I’m particularly vigilant about “authorization” sections — the perfect hiding spot for extra per-transaction fees.

- Don’t Trust Fee Names: This last tip sounds strange at first, but hear me out. Names and abbreviations for fees have little standardization across the industry — even wholesale fees that are supposed to be the same for everyone! This makes it all the more difficult to identify extra or padded fees on a statement. If you’re trying to pin down a particular charge, it’s often best to consider the amount first while taking the fee’s name with a grain of salt. Here’s one good rule of thumb: Just because a charge has a card brand abbreviation in front of it doesn’t guarantee it’s all from the card brand!

Poor layout example: An MSP markup fee buried in the middle of a giant alphabetical list of wholesale card brand fees. And, the section name is just “Other Fees.” Not cool! (Note: this is an old statement with non-current card brand fee amounts)

Fine-Tuning Your Fees

We’re about take this detailed numbers analysis thing to the next level. Ready?

So, remember how we said that wholesale fees are fixed, non-negotiable and completely out of your control, and that markups from your MSP are the variable, negotiable costs of processing? Well, in reality, this is a slight oversimplification of the system. There are some nuances and gray areas that once recognized on your statement can help you catch problems, and potentially even adjust your processing habits to save money.

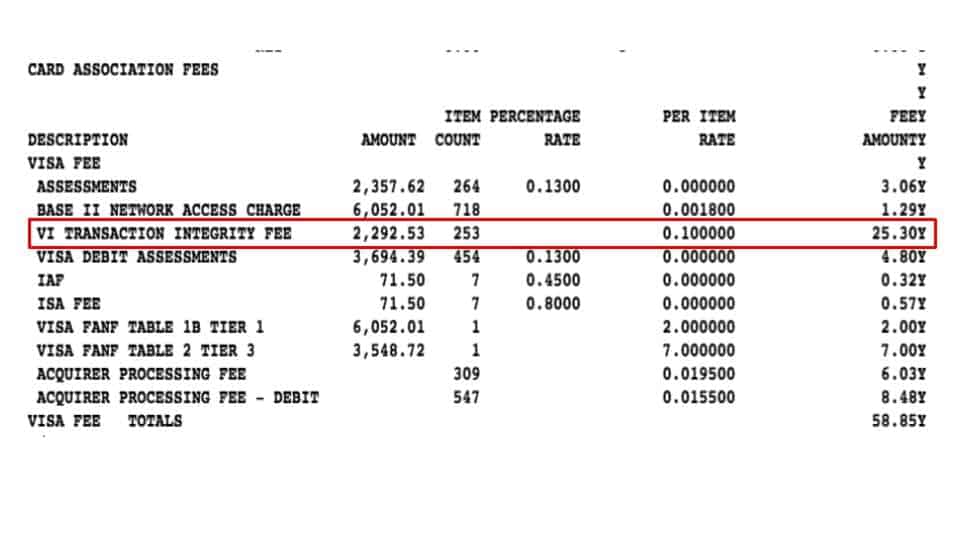

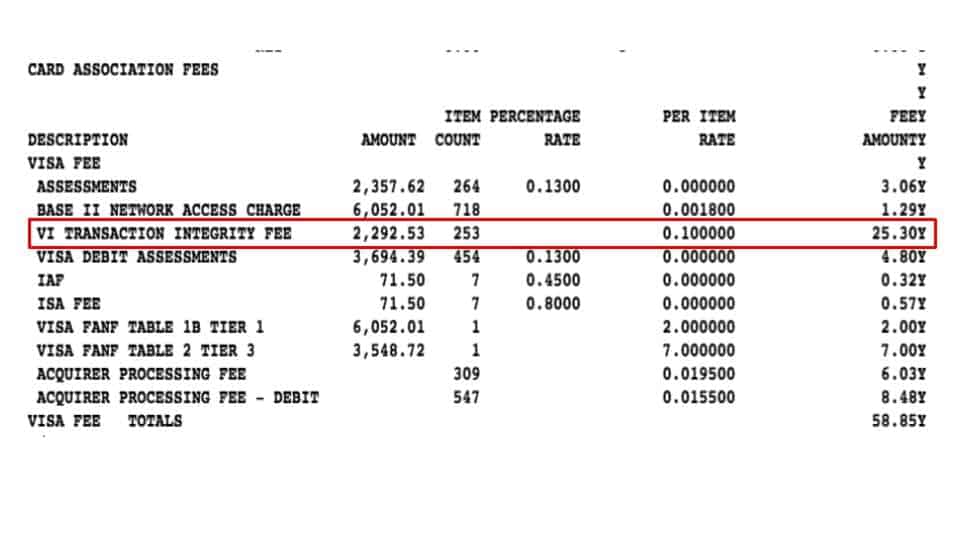

- Avoidable Penalty Fees: Most card brand fees are simple, blanket assessments on your transactions, but others are in place specifically to punish you for not following the proper protocols for authorization and settlement. They’re small fees, but can add up fast if they’re applied to a large portion of your transactions. If you’re seeing a lot of transaction “integrity” type fees, you should take the initiative to find out why this is happening. (While we’re on the topic, don’t forget that MSPs can also charge avoidable penalty fees — a PCI-non compliance fee is one common example.)

- Optimizing Interchange Rates: While interchange rates themselves are fixed and pre-established across the processing industry, you may have more control over which categories of interchange your transactions fall into than you think. The process of ensuring you get the best interchange rates possible is called interchange optimization. B2B transactions using commercial cards can be processed with additional Level 2 and Level 3 data to get the optimal interchange rate, for example. Transactions can also end up “downgraded” to higher-cost interchange categories if you do not authorize and settle them properly (in this way, downgrades are basically another type of penalty fee). Interchange downgrades happen more commonly to card-not-present businesses because there is more margin for data-entry error and omission than when cards are read directly by processing equipment. Common statement codes for downgraded interchange rates include EIRF (electronic interchange reimbursement fee) and STD (standard). It’s normal for a few transactions to be downgraded, but if you’re seeing interchange downgrades on the majority of your transactions, this is a definite red flag.

This merchant’s largest Visa Card Brand fee for the month was $25.30 for 253 transactions that didn’t follow proper authorization/settlement procedures. It’s likely these transactions are getting downgraded to higher-cost interchange categories as well. The merchant should look into adjusting its processing procedures to avoid these unnecessary costs.

Pulling It All Together

After you’ve worked through the details of your 2-3 consecutive statements, it’s worth repeating your effective rate calculation on each one, just to ensure you didn’t miss any charges. You may have also spotted an extra or padded fee here and there that you’re ready to confidently take up with your MSP. You should also be able to locate any anomalies that occurred during a given month (e.g., excessive penalty fees, chargebacks, one-time incidental fees, etc.) that may have impacted your effective rate.

If your statements itemize interchange rates and card brand fees separately from markups (interchange-plus or subscription models only), you’re finally ready to do that magical effective markup calculation accurately. Remember to only count interchange fees and card brand fees as true wholesale. Everything else is technically a markup!

Final Thoughts

We’ve covered a lot of ground in this guide, but hopefully you’re ready to tackle some big-picture calculations (like your effective rate), as well as better identify any specific “what the heck is that?” charges from your statement. If you’re ready to become the consummate master of your processing statements from here on out, the first step will be to get on a cost-plus pricing model (interchange-plus or subscription/membership). This is the only way you’ll see what you’re paying each month above wholesale processing costs that are largely out of your control. All but very small merchants will benefit from one of these pricing models from a trustworthy MSP. If you’re not on a cost-plus plan already, make it a priority if you change providers.

Meanwhile, keep on tracking that effective rate (and effective markup if your statement allows) month-over-month for the lifetime of your merchant account. Once you’ve got a handle on your statement, it will be totally worth the 12 seconds the calculation will take you each month. I’m a super detail-oriented person as a matter of principle, and even I give you my blessing to pretty much ignore all the stupid little fees and markups your processor or MSP may charge, as long as you’re satisfied your big picture numbers are remaining sensible and consistent. Just know I’ll send you right back into the details if those effective numbers go up!

Still need help with pricing or statements? Check out the transparent pricing of our highest-rated merchant account providers.