Level Up Your Business Today

Join the thousands of people like you already growing their businesses and knowledge with our team of experts. We deliver timely updates, interesting insights, and exclusive promos to your inbox.

Join For Free💳 Save money on credit card processing with one of our top 5 picks for 2025

Don't know which to choose for payment processing in the Stripe versus Shopify battle? We're here to help! Read our guide to find out which is the better fit for your small business.

Stripe and Shopify are popular among new business owners for their comprehensive, ready-to-use solutions for selling products or services and processing payments. Both cater primarily to eCommerce businesses but also offer features for retail enterprises. This versatility qualifies them as being among the best credit card processors for small businesses.

This article will compare Shopify’s and Stripe’s pricing and features, focusing primarily on each company’s payment processing capabilities.

Table of Contents

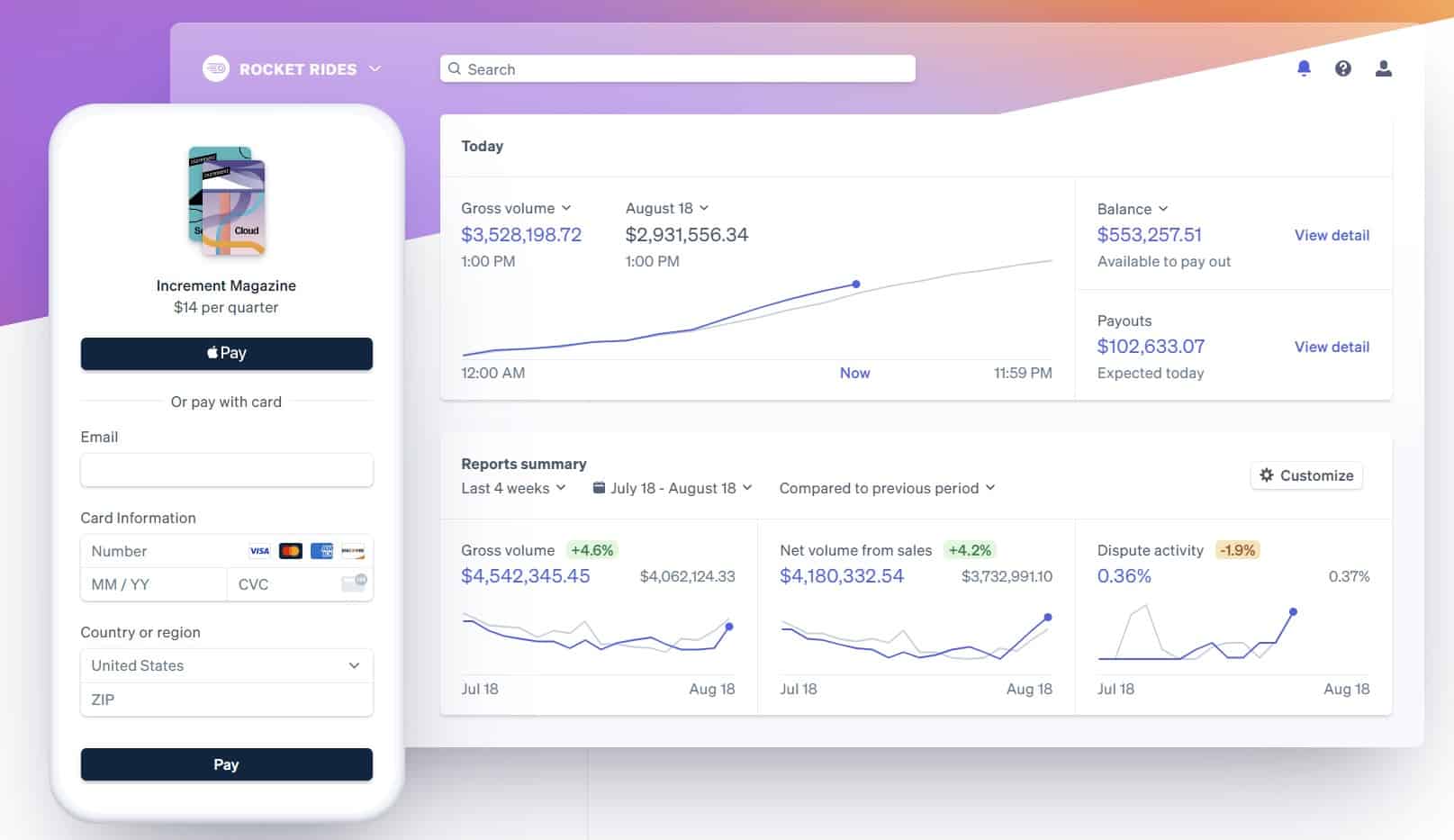

While Stripe and Shopify both offer payment processing, Shopify also includes an extensive online store, allowing businesses to obtain every feature they need from a single vendor without having to do any programming. Stripe, however, generally allows users to custom-build their own website from scratch — something that requires significant coding experience.

| Stripe | Shopify | |

|---|---|---|

| Ideal For |

|

|

| Pricing |

|

|

| Standout Features |

|

|

| What’s Missing |

|

|

Stripe Payments is ideal for an ecommerce-only business or one that only occasionally needs to accept an in-person payment. Figuring out how Stripe works and how to integrate it into your business can be challenging due to the extensive customization options available. However, newly launched businesses can use Stripe’s basic payment gateway features out of the box without the need for technical skills. To take full advantage of Stripe’s many advanced customization features, you’ll need a developer or your own coding knowledge.

Stripe offers a simple, predictable pricing structure for new businesses, but you can also obtain a customized pricing quote that will probably save you a lot of money on processing costs once your monthly processing volume reaches a higher level.

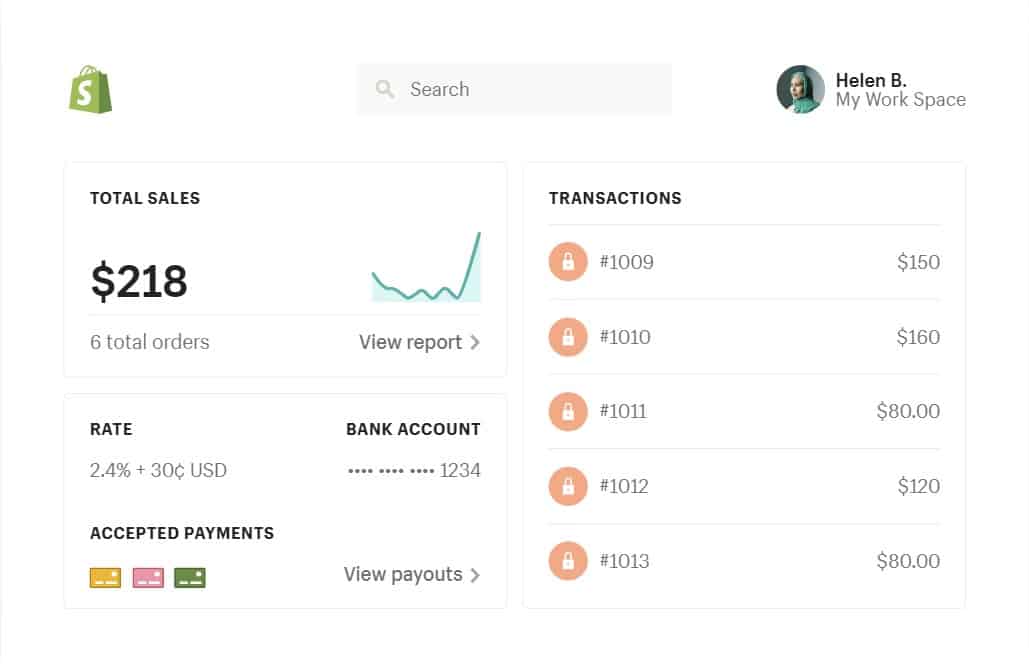

Shopify Payments — which is actually powered by Stripe — is Shopify’s built-in payment processing service. You can also use Shopify with a third-party processor of your choice. However, you’ll have to pay additional fees to Shopify for every transaction you process if you choose this option. For most small businesses, it’s easier and more affordable to stick with Shopify Payments if you’re going to sign up with Shopify.

Like Stripe, Shopify offers true month-to-month billing with no long-term commitment. While the Shopify Payments processing service is included for free with your Shopify account, Shopify itself requires a monthly subscription fee. Shopify Payments uses a flat-rate pricing plan that’s very similar to Stripe, which will make your monthly statements easy to understand and keep your overall processing costs predictable.

Stripe excels at the sheer variety of customization options available to merchants who want a top-notch website for their business. Unlike Shopify, Stripe also offers customized pricing for high-volume businesses. This option can help lower your overall processing costs by using interchange-plus pricing instead of the standard flat-rate pricing advertised on the Stripe website.

Stripe also offers a number of features that you won’t find with Shopify, including support for ACH payment processing, invoicing features, and recurring billing support.

As a payment service provider (PSP), Stripe offers aggregated accounts and can thus be prone to the same account stability issues that plague other PSPs like Square or PayPal. Also, Stripe isn’t as friendly to non-programmers as Shopify, and you’ll need either extensive coding skills or access to a developer to take full advantage of Stripe’s extensive variety of customization options.

Although it’s still primarily an eCommerce-oriented provider, Stripe has expanded its support for retail businesses in recent years. The company now offers both mobile card readers and traditional countertop terminals but has yet to release a full-blown POS hardware product.

Unlike Stripe, Shopify offers an out-of-the-box solution for launching an online business that doesn’t require extensive coding skills. You also won’t be limited to just Shopify-branded features, as the company’s platform integrates seamlessly with a variety of third-party services.

Shopify’s support for in-person payments is also more user-friendly than Stripe’s. Card readers and terminals can be used out of the box without having to write any customized code. Shopify also offers an iPad-based POS system, although you’ll have to supply the iPad.

For some small businesses, Shopify’s monthly subscription fees will make it a less-affordable option than Stripe. However, the company offers several tiers of service, allowing you to start with a more affordable plan and move up to a higher tier as your business grows. We’re also somewhat disappointed with Shopify’s lack of support for ACH payments, given how useful this payment method is for online businesses.

Shopify is also not a good option for freelancers or independent contractors, as it doesn’t offer support for invoices or recurring billing.

| Stripe | Shopify | |

|---|---|---|

| Monthly Fee | None | $5-$299 (depends on the plan) |

| Pricing Model | Flat-rate | Flat-rate |

| Online Transactions | 2.9% + $0.30 | 2.5%-2.9% + $0.30 (depends on the plan) |

| In-Person Transactions | 2.7% + $0.05 | 2.4%-2.6% + $0.10 (depends on the plan) |

| Hardware Options |

|

|

| ACH Payments | 0.8%/transfer ($5.00 cap) | N/A |

| Invoices |

|

N/A |

| PCI Compliance | No charge | Included w/monthly subscription plan |

| Chargebacks | $15/occurrence | $15/occurrence |

The key difference in pricing between Stripe and Shopify is that Shopify charges a monthly subscription fee for its online store, whereas Stripe accounts come with no monthly fee. Transaction processing costs are nearly identical, although Shopify offers lower rates if you choose a more expensive monthly plan.

In determining which provider will be less expensive for your business overall, you’ll also have to factor in the cost of any optional add-ons that you need. Shopify’s monthly subscription fees aren’t cheap, but they may save you the expense of hiring a developer if you can’t customize Stripe’s many options on your own. At the same time, Stripe offers customized pricing for high-volume businesses, whereas Shopify does not. Customized pricing usually includes lower processing rates but may also come with additional monthly fees.

For more detailed pricing information, check out our complete guide to Stripe pricing.

Although they’re both primarily e-commerce platforms, Stripe and Shopify offer hardware for accepting in-person payments.

Stripe’s system, Stripe Terminal, offers you a choice between the Stripe Reader M2, the BBPOS WisePOS E terminal, and the Stripe Reader S700 (coming soon). The Stripe Reader M2 is a battery-powered mobile card reader that connects via Bluetooth and enables mobile payments. The WisePOS E is an integrated terminal with a 5″ touchscreen that can be used as a mobile or countertop device. The new Stripe Reader S700 is an Android-based smart terminal that can run your own customized POS software. Stripe also supports Tap To Pay for both iPhones and Android devices, which allows contactless payments without the need for any additional hardware. Several other third-party devices are pre-certified to work with Stripe’s processing network. Note that with any of these choices, you’ll have to build your own checkout flow and customize it for your business.

The Shopify POS Go is a smartphone-sized mobile terminal that can also work in a countertop setting and integrates with a number of accessories, such as receipt printers. Shopify also offers the Shopify Tap & Chip Carder Reader, which can connect via Bluetooth to your smartphone or tablet. The company’s new Shopify POS Terminal can function as a standalone countertop terminal or be used in conjunction with Shopify’s iPad-based POS software through a $549 Countertop Kit (which does not include an iPad). Shopify supports Tap To Pay contactless payments, but only for iPhones at this time. Shopify’s primary advantage over Stripe is that its devices come pre-programmed and will (or at least should) work out of the box without any additional coding required.

| Stripe | Shopify | |

|---|---|---|

| Virtual Terminal | Only available through Paytia third-party integration | Only available through third-party integration |

| Customer Information Management | ||

| Inventory Management | Requires third-party integration | |

| Invoicing | N/A | |

| eCommerce Store | ||

| Recurring Billing | N/A | |

| Payment Links | ||

| QR Codes | ||

| Social Media Selling | ||

| Next Steps | Visit Site Read Review |

Visit Site Read Review |

Stripe and Shopify offer fully-featured integrated payment platforms that handle all your online payment processing needs.

In terms of support for in-person transactions, however, Shopify emerges as a clear winner.

Stripe has recently begun to offer support for retail transactions, but its current Stripe Terminal service requires you to build your own customized checkout using precertified third-party card readers. On the other hand, Shopify offers mobile card readers and POS software systems that work right out of the box. With Stripe’s recent acquisition of terminal manufacturer BBPOS, we anticipate that the company will expand its in-person offerings in the near future, and these current limitations will become a thing of the past. For now, however, Shopify offers a much more convenient way to accept in-person payments.

Both Stripe and Shopify offer a lot to any e-commerce business with a retail sales channel. Both companies offer complete payment processing systems that don’t require a long-term contract and very similar pricing. Choosing between them will often come down to selecting the provider that offers the specific features your business needs the most.

We generally recommend Shopify to new business owners who need a simple, all-in-one solution to accept payments. For more sophisticated users with specialized needs, Stripe offers a more powerful and customizable platform — if you have the technical skills to take advantage of its advanced features.

In making a final decision between these two providers, consider the following:

Credit Card Processing With Superior Support

Helcim  |

|---|

With Helcim, you get everything you need to accept credit card payments online or in-person with a free account, plus high-quality support from real humans. Start For Free.

Credit Card Processing With Superior Support

Helcim  |

|---|

With Helcim, you get everything you need to accept credit card payments online or in-person with a free account, plus high-quality support from real humans. Start For Free.

Let us know how well the content on this page solved your problem today. All feedback, positive or negative, helps us to improve the way we help small businesses.

Give Feedback

Want to help shape the future of the Merchant Maverick website? Join our testing and survey community!

By providing feedback on how we can improve, you can earn gift cards and get early access to new features.

Whether you're looking to save money on processing or to get approved for a merchant account, PaymentCloud can help.

Get Started

Whether you're looking to save money on processing or to get approved for a merchant account, PaymentCloud can help.

Get Started

Help us to improve by providing some feedback on your experience today.

The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation.

Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication. Merchant Maverick’s ratings are not influenced by affiliate partnerships.

Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are author’s alone.

Whether you're looking to save money on processing or to get approved for a merchant account, PaymentCloud can help.

Get Started

Whether you're looking to save money on processing or to get approved for a merchant account, PaymentCloud can help.

Get Started